Warehouse automation leverages advanced technology and machinery to optimize warehouse operations, covering all aspects, from material handling to inventory management. This approach employs a variety of systems, including conveyor belts, automated storage and retrieval systems (AS/RS), robotic picking stations, and automated guided vehicles (AGVs). These tools collectively enhance efficiency from the initial receipt of goods to their final shipment. The primary goals are to increase operational speed, minimize manual labor, and improve process accuracy.

Warehouse automation provides substantial competitive advantages and is widely applicable across diverse retail, e-commerce, manufacturing, and logistics sectors. It streamlines supply chain operations, boosts customer service, and allows the reallocation of human resources towards more strategic tasks. By improving operational efficiency, warehouse automation enhances a company’s competitiveness and positions it for future growth and innovation in a rapidly evolving market.

Warehouse Automation Market Size

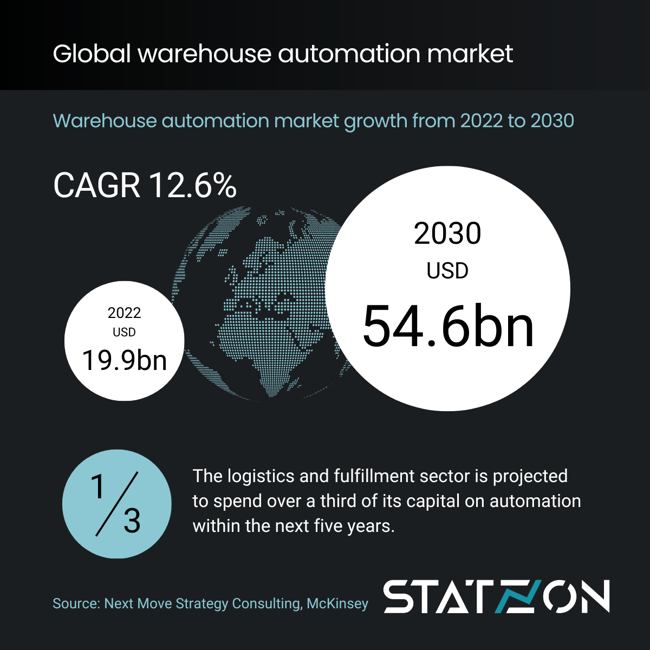

Despite a recent slowdown, the warehouse automation sector is poised for significant transformation and growth. Initially impacted by challenges such as labor shortages and fluctuating e-commerce demands, the industry has begun to rebound robustly. Current projections indicate that by 2027, approximately one-quarter (26%) of warehouse sites will be automated, marking a notable increase from earlier years. Research from McKinsey underscores this trend, suggesting that companies are preparing to substantially boost their investments in automation over the next five years. Businesses allocate about 25% of their capital expenditures to automation technologies. This is especially pronounced in the logistics and fulfillment sector, which is expected to dedicate over a third of its capital investments to enhancing automation. This strategic focus reflects a broader industry movement to innovate and improve efficiency through advanced technology.

With the significant increase in investment, the warehouse automation market is expected to grow at a CAGR of 12.6% from 2023 to 2030, according to a report published by Next Move Strategy Consulting. The global warehouse automation market, which stood at USD 19.9 billion in 2022, is forecast to reach USD 54.6 billion by 2030.

Leading Countries in the Warehouse Automation Market

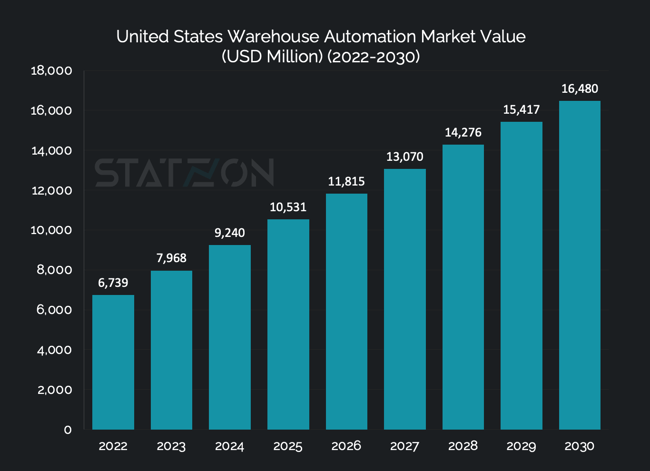

According to Next Move Strategy Consulting, the United States (US) leads the global landscape in warehouse automation, boasting a significant market value of USD 6.7 billion in 2022, with projections to grow at a CAGR of 9.2% to reach USD 16.5 billion by 2030. This growth is driven by the presence of retail giants such as Amazon, Walmart, and Target, which drive demand for advanced automation solutions and contribute to the US's leadership in warehouse construction and innovation.

Source: Statzon/Next Move Strategy Consulting

Source: Statzon/Next Move Strategy Consulting

Following the US, China and Germany hold significant positions in the warehouse automation sector. China's warehouse automation market achieved revenues of USD 2.2 billion and is expanding faster than the U.S., with a CAGR of 12.4%. As the leader in Europe for warehouse automation, Germany's market was valued at USD 1.8 billion and is anticipated to increase to USD 3.8 billion by 2030, demonstrating a relatively conservative CAGR of 7.9%.

Warehouse Construction Boosts Warehouse Automation Market Growth

After a period of slowdown in 2023, Interact Analysis predicted that the warehouse construction sector is showing signs of recovery and is expected to grow in 2024. Influenced by a decline in e-commerce growth and higher interest rates, the downturn is beginning to reverse as e-commerce stabilizes and real-estate developers anticipate more activity in the coming years.

China and the US lead in warehouse construction, accounting for 58% of the global increase in warehouse square footage in 2022.

Amazon leads in global warehouse count with over 1,500, outpacing Walmart (80% fewer) and Target. Yet, its per-warehouse automation investment lags behind Adidas by 14x, as per Interact Analysis’ study. This discrepancy is attributed to Amazon's extensive warehouse network and a forecasted deceleration in its automation spending, suggesting a strategic calculation that balances expansion with technological investment. Other retailers like Adidas, Walmart, and Aldi are among those expected to increase their automation investments within the near future significantly.

China, on the other hand, is aggressively expanding its warehouse footprint beyond its borders, aiming to enhance the global reach of its e-commerce and manufacturing sectors. This strategy involves establishing overseas warehouses to streamline the distribution of Chinese goods to international markets. For example, JD.com is establishing a distribution center as a crucial component in the supply chain for John Lewis, the UK's leading department store.

Similarly, Alibaba's logistics arm is set to expand its global footprint, with plans to establish more local warehousing and distribution centers in North America, Europe, and Southeast Asia.

This strategic expansion is expected to speed up deliveries by an average of 30 percent compared to the industry standard, significantly enhancing the efficiency of global supply chains.

Warehouse Automation Market Segmented by Type of Technology

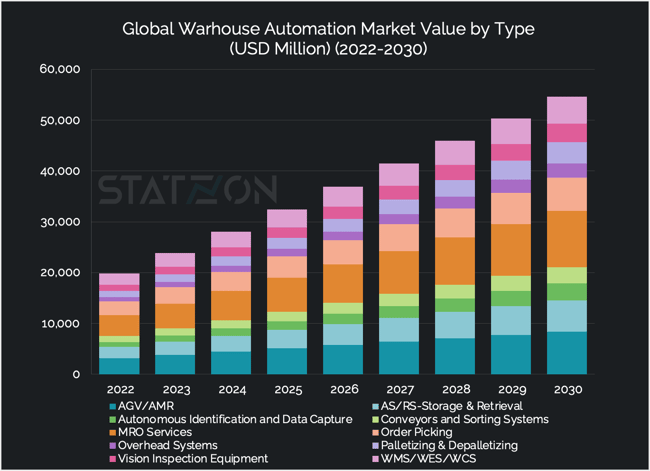

Based on type, Next Move Strategy Consulting segmented the market into 10 categories: AGV/AMR, AS/RS-storage & retrieval, autonomous identification & data capture, conveyors & sorting systems, MRO services, order picking, overhead systems, palletizing & depalletizing, vision inspection equipment, and WMS/WES/WCS.

Among these segments, MRO services emerged as the largest market in 2022, valued at USD 4.1 billion, and is projected to maintain its leading position, reaching USD 11.1 billion by 2030 with a CAGR of 10.72%.

Following MRO services, the second-largest segment in 2022 is order picking, valued at USD 2.8 billion, and expected to grow to USD 6.5 billion by 2030 with a CAGR of 9.08%. The third-largest market in 2022 is AGV/AMR, valued at USD 3.2 billion, and forecasted to reach USD 8.4 billion by 2030, with a CAGR of 10.52%.

Meanwhile, the segment showing the highest growth rate is overhead systems, with a CAGR of 14.22%, followed closely by palletizing & depalletizing and autonomous identification and data capture, which are expected to grow at 13.8% and 13.66% CAGRs, respectively.

Source: Statzon/Next Move Strategy Consulting

Source: Statzon/Next Move Strategy Consulting

Robotics Adoption in the Warehousing Industry

Warehouse robotics represents a growing segment within the broader spectrum of warehouse automation solutions. According to another research conducted by Next Move Strategy Consulting, the global warehouse robotic market reached a value of USD 6 billion in 2022 and is projected to achieve USD 15.7 billion by 2030, demonstrating a robust Compound Annual Growth Rate (CAGR) of 11.8%.

Mobile robots, including both automated guided vehicles (AGV) and automated mobile robots (AMR), are key components in warehouse automation. They dominate a significant portion of the total warehouse robotics market, accounting for approximately 53% of all warehouse robotics demand in 2022.

In addition to these mobile robots, various other types of robots are also being deployed in warehouse automation, including SCARA, cylindrical, articulative, and collaborative robots, commonly known as cobots. While cobots currently represent a smaller segment of the overall warehouse robotics system, they exhibit the highest market growth rate compared to other types of robots in the warehouse robotics market, with a notable CAGR of 14.3%.

Top Companies in the Warehouse Automation Market

The warehouse automation market is dominated by a select group of industry leaders, with six major players accounting for over 50% of the market share, as reported by LogisticsIQ. Among these top companies are Dematic, Daifuku, Toyota Advance Logistics, Honeywell, Fortna, and KNAPP. Some other names included as the top companies in the market are SSI Schafer, Murata Machinery, Koerber, Witron, Symbiotic, TGW, AutoStore, and Swisslog. These companies have established themselves as key players in delivering advanced automated warehouse solutions, with a strong presence and significant market influence.

LogisticsIQ has compiled a comprehensive list of warehouse automation companies across various technological domains. Here are some key players in different areas:

- Material Handling Equipment: Dematic, Daifuku, SSI Schafer, Honeywell Intelligrated, Murata Machinery, and FIVES.

- AGV/AMR: Geek+, Quicktron, Amazon Robotics, Grey Orange, HikRobots, and MiR.

- Warehouse Management System (WMS): AFS Technologies, Aptean, Consafe Logistics, DataByte, Davanti, and Deposco.

- Micro-Fulfillment: Takeoff Technologies, Fabric, Dematic, Knapp, Murata Machinery, and Alert Innovation.

- Piece Picking Robots: Righthand Robotics, Kindred AI, Knapp, Universal Robotics, Berkshire Grey, and Plus One Robotics.

- Last Mile Delivery: Myrmex Robotics, Cleveron, Starship Robots, Nuro, Refraction AI, and LogiNext.

- Automatic Identification and Data Capture (AIDC): Zebra Technologies, Datalogic, Cognex, SATO, Honeywell AIDC, and SICK.

- Autonomy Service Providers (ASP): Covariant AI, Brain Corp, Balyo, Mov AI, Amazon Canvas, and WIBOTIC.

- Warehouse Drones: PINC Solutions, Drone Delivery Canada, Dronescan, Eyesee Drone, Infinium Robotics, and Matternet.

Source: Statzon, Next Move Strategy Consulting's Report on Warehouse Automation Market, Interact Analysis (1), Interact Analysis (2), McKinsey, LogisticsIQ