Hydrogen plays an important role in the current net-zero emissions movement, representing a key component in the hydrogen economy. Its versatility as a zero-emission fuel and energy carrier makes it a promising solution for decarbonizing various sectors, such as industrial processes, power generation, and transportation. Hydrogen-powered electric vehicles (EVs) are gaining attention as a potential alternative to gasoline-powered cars, given their longer driving range and faster refueling time. With the global hydrogen market expected to grow exponentially in the coming years, the role of hydrogen in the net-zero movement and its connection to EVs are becoming increasingly significant. The question remains whether hydrogen-powered EVs have the potential to surpass battery-powered EVs.

Global Green Hydrogen Market

Today, most hydrogen is sourced from fossil fuels, also known as grey hydrogen, which undermines its potential as a clean energy source. Hydrogen production technologies, such as electrolyzers, are vital in the shift towards sustainable hydrogen production. Different types of hydrogen technologies are typically labeled as 'grey', 'blue', or 'green', depending on how they are produced. Although hydrogen itself only emits water when burned, the production process can generate significant carbon emissions. To truly realize the benefits of hydrogen, the world must transition towards green hydrogen, which is produced using renewable energy sources such as water, wind, and solar.

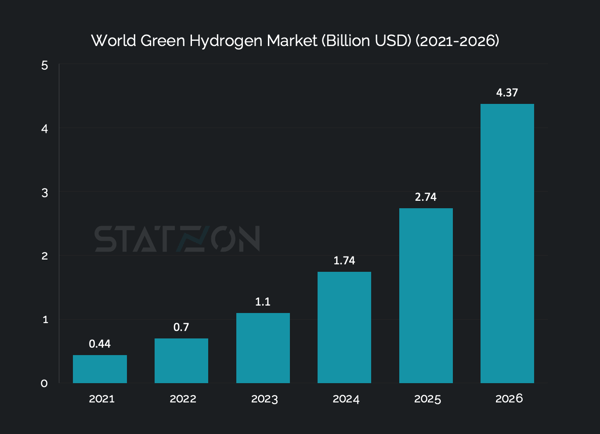

The global green hydrogen market was valued at USD 676 million in 2022 and is projected to reach USD 4.4 billion by 2026, based on estimates from the research firm MarketsandMarkets. The mobility sector is the largest adopter of green hydrogen, accounting for 58% of the total market in 2022, followed by the power sector. Both sectors are growing at a 63% CAGR. Other sectors contributing to the green hydrogen market include grid injection, chemical, and industrial, according to MarketsandMarkets classification.

Source: Statzon/ MarketsandMarkets

Source: Statzon/ MarketsandMarkets

Global Demand for Green Hydrogen

Demand for hydrogen was around 94 million tons in 2021, most of it in the form of grey hydrogen. But by 2050, demand for clean hydrogen, which includes green and blue hydrogen (sourced from fossil fuel but using a technology called carbon capture, utilization, and storage (CCUS) that would significantly reduce carbon emissions), could surge to 500-600 metric tons by 2050 as estimated by two major consulting firms, BCG and McKinsey. To meet that demand, an investment of USD 700 billion is required to produce, distribute, store, transport, and for other costs related to the end-use application of green hydrogen, according to McKinsey estimates.

To increase the production of clean hydrogen, The Green Hydrogen Catapult, a United Nations initiative, has committed to developing 45GW of electrolyzer by 2026, with targeted commissioning by 2027. This marks a significant increase from the initial target of 25 GW that was set by the coalition when it was launched in December 2020.

Global Hydrogen Generation Market

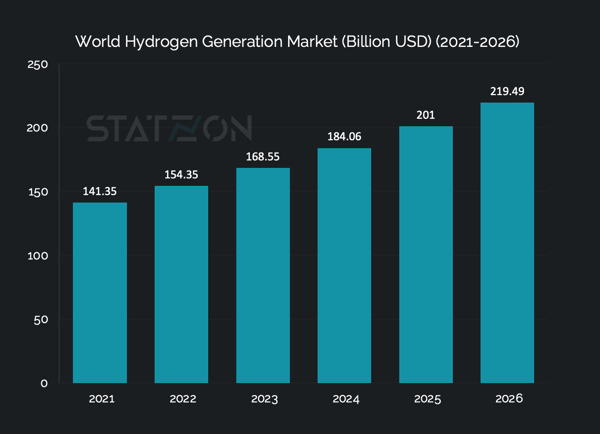

Electrolyzers use electrolysis process to split water into hydrogen and oxygen using electricity which gives out zero carbon emissions. Electrolysis is a promising technology for hydrogen production in the future and it is the fastest growing segment in the global hydrogen generation market, a market worth USD 154 billion in 2022 and is predicted to hit USD 219 billion by 2026, according to MarketsandMarkets.

Source: Statzon/ MarketsandMarkets

Source: Statzon/ MarketsandMarkets

Grey hydrogen makes up most of the hydrogen produced in today’s time due to its lower production cost compared to blue and green hydrogen. The production of low-emission hydrogen was around 0.6 Mt in 2021 (less than 1% of global hydrogen production). Getting on track with the Net Zero Scenario requires the production of low-emission hydrogen to be scaled up to reach a total production of 95 Mt by 2030, as indicated by the International Energy Association (IEA).

CCUS is still the most popular low-carbon hydrogen generating method because it requires lower operating costs relative to other low-carbon technologies like electrolysis. But this should change in the future when green hydrogen price starts to get competitive, most likely after 2030. Around two-thirds of low-carbon hydrogen production in 2030 will be based on electrolysis, while the remaining one-third is hydrogen produced from fossil fuels with CCUS.

Green Hydrogen Price Trajectory

Green hydrogen production costs will decrease by around 50% through 2030 and then continue to fall steadily at a slightly slower rate until 2050. Sometime after 2030, green hydrogen prices would be on par with those of grey hydrogen but still higher than the price of blue hydrogen. By 2050 green hydrogen production price will be lower than the production of both grey and blue hydrogen.

Current production cost of grey hydrogen can go below USD 1/kg in natural resources-rich countries such as the US, Russia, and the Middle East but can be higher up to USD 2/kg in Europe or Asia.

Green hydrogen produced by electrolysis, on the other hand, costs around USD 3-8/kg. If production costs continue to fall as predicted, green hydrogen could hit the USD 2/kg benchmark by 2030 and further decrease to USD 0.70 – USD 1.60 per kg by 2050 in most parts of the world. This price range would make green hydrogen more affordable and competitive with natural gas.

The Market for Hydrogen-powered Vehicles

Hydrogen combustion engines can offer a zero-emission transport solution and simultaneously foster the expansion of hydrogen infrastructure. Hydrogen-powered vehicles utilize hydrogen fuel cells to generate electricity, emitting only water vapor as a byproduct, making them an attractive option for reducing greenhouse gas emissions in the transportation sector.

Hydrogen ICE vehicles demand slight adjustments when compared to conventional ICE vehicles. They serve as viable options for those who want greener vehicles than the normal petrol-powered ICEs but have limited access to battery-powered vehicles.

The use of hydrogen technology may be most appropriate for off-road vehicles due to the infrastructure challenges that battery electric and fuel cell alternatives may face in these environments. Hydrogen policy and government incentives play a significant role in determining the feasibility and deployment of these technologies.

Off-road vehicles, and some on-road off-highway vehicles, are perhaps best suited to hydrogen technology due to the difficulty of electrifying large and heavy structures. Unlike battery electric vehicles, which would require different designs for BEV powertrains to accommodate different sizes and duty cycles of off-road vehicles, hydrogen technology can provide a more standardized solution. Additionally, battery electric and fuel cell alternatives may face infrastructure challenges in off-road environments, making hydrogen technology a more practical option.

However, volume matters. With off-road trucks, you have to create a new truck for each job. This means that manufacturers may still prefer on-road trucks because they can sell more of them.

The consulting company Interact Analysis published quite interesting research about hydrogen ICE vehicles. According to their research, mass production is predicted to take off within 5 years. Although the costs of engines and vehicles are low, running costs are high, leading to unfavorable total cost of ownership. However, the cost of a hydrogen engine is only slightly higher than that of a diesel engine, making it best suited for low mileage/hours-per-day applications. Maintenance costs are similar to other vehicles, but the TCO is worse than diesel and battery electric alternatives due to high fuel costs. H2 vehicles are likely to be limited to regions where diesel is banned, or BEV alternatives are not available.

The research also shows that forklifts currently dominate the hydrogen off-highway market, but larger vehicles like haul and dump trucks and excavators are gaining popularity. North America has the largest market for hydrogen forklifts, with Walmart and Amazon being major customers. While Europe, Japan, and China are developing hydrogen forklift projects, the scale is smaller compared to North America. China is expected to increase its market share, with over 20,000 hydrogen forklifts forecast to be shipped there by 2030. Early progress is being made in the hydrogen rail, maritime, and aerospace markets, but it will be limited before 2030.

The Market Size of Hydrogen Fuel-cell Vehicles

As the world shifts towards electric transportation, battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) have become increasingly common. However, fuel cell electric vehicles (FCEVs) have also emerged as an appealing alternative to BEVs. These vehicles are powered by hydrogen fuel cells, which generate electricity through a chemical reaction with hydrogen, resulting in only water vapor emissions. While FCEVs share similarities with EVs, they differ in significant ways and are still relatively uncommon.

As per IEA data, there were approximately 72,000 FCEVs in 2022. A 40% increase from 2021 stock. About 80% of the FCEVs are cars, 10% trucks and almost 10% buses. In the same year, sales of electric cars exceeded 10 million (BEVs and PHEVs combined) in the world, stock up to 26 million. We still have to wait for IEA to publish their 2023 data.

While BEV sales are rapidly taking off in Europe, Asia is taking an interest in fuel-cell vehicles. The Japanese government plans to have 800 000 hydrogen vehicles on the roads by 2030 while China has set an ambitious target of 1 million by 2035. This move is against a growing consensus that the opportunity for FCEVs in the global passenger vehicle market is shrinking fast, due to infrastructure constraints and high running costs relative to battery-electric equivalents.

However, the global hydrogen car market has encountered challenges, particularly in 2023. Sales for the first seven months of the year are down 9.6% year-on-year. This decline is most pronounced in South Korea, which has historically been one of the biggest markets for FCEV cars. In July, a 38% year-on-year drop in sales was reported in South Korea. Despite the country's official target of 270,000 hydrogen cars on its streets by 2030, alongside 30,000 buses and trucks, the recent cut in subsidies for H2-powered cars casts doubt on the feasibility of this goal. In contrast, markets like China and the United States are witnessing a surge in hydrogen vehicle interest.

How Does FCEV Differ from BEV, and Why Hasn't It Taken Off Yet?

Aside from the obvious technology employed to power the vehicle, FCEVs can be refueled in a short amount of time, the same time it takes to fill a petrol car. It also offers a much longer driving range than BEV. However, it comes with several challenges.

First of all, there is the problem of efficiency. When hydrogen is converted into electricity in a fuel cell, some of the energy is lost during the process. Only around 60% of the energy stored in the hydrogen can be converted into electricity. The remaining 40% is lost as heat or in other processes. Combined with the high price of hydrogen today, FCEV’s total cost of ownership (TOC) is generally higher than that of BEV.

Hydrogen Infrastructure Development

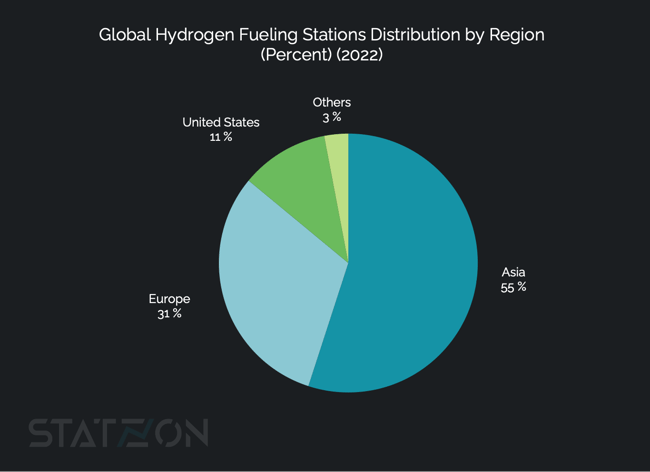

Another big challenge for FCEVs is the lack of hydrogen refueling stations which makes it challenging for FCEV owners to travel long distances or even find a place to refuel. According to H2stations.org latest audit, there were only 814 hydrogen fueling stations in operation across 37 countries worldwide at the end of 2022. An addition of 130 stations compared to 2021. Another 315 stations are already in the planning stage. By comparison, the number of public charging points available for BEVs and PHEVs was significantly greater. In 2022 alone, about 900,000 new stations were installed, bringing the total to over 2.7 million charging points globally, as reported by IEA.

More than half (455) hydrogen stations are operating in Asia 165 in Japan, 149 in South Korea, and 138 in China. South Korea was again leading globally with 45 new fueling stations and is increasingly expanding the infrastructure for all fuel-cell electric vehicles. Europe had 254 hydrogen stations at year-end, 105 of which were in Germany. North America had in total 89 stations, 70 of them located in California.

Hydrogen Fuel Cell Trucks Market Potential

The question remains. Will FCEV be able to keep pace with BEV?

With the exception of Japan and South Korea, it is widely believed that fuel-cell cars are unlikely to compete with BEVs. This is due to the advancements in electric vehicles and charging infrastructure, which are becoming more cost-effective and efficient. Battery-electric vehicles make far more sense, especially for the passenger car segment, even though 80% of new FECVs sold in 2022 are in the passenger car category.

BEVs have the great advantage that they can leverage the existing electric grid infrastructure, with practically every electrical outlet serving as a potential charging point. This also makes charging at home possible for BEV owners. The widespread adoption of hydrogen technology for sustainable road transportation is unlikely to occur anytime soon. Our focus should be on the growth of battery-electric vehicles.

This study recognizes the challenge faced by battery-electric vehicles is the transportation of heavy cargo over long distances, averaging around 100,000 kilometers per year, resulting in high energy consumption per kilometer. This is where fuel-cell trucks are often discussed as a potential solution. However, the major challenge is to assess whether these niche markets are substantial enough to promote the commercialization and cost-effectiveness of fuel-cell electric trucks, as well as the necessary infrastructure to support them.

Another study done by the Fraunhofer Institute believes that hydrogen is unlikely to play a major role in road transport. For the majority of regions and commercial vehicle purposes, battery-electric heavy-duty vehicles hold a greater advantage compared to fuel cells. The use of fuel cell trucks is a gamble on the potential availability of inexpensive and entirely renewable imported hydrogen in the medium term.

McKinsey, however, shows some optimism for the fuel-cell truck market, taking Switzerland as an example, where fuel-cell trucks are already successfully deployed. The firm believes FCEVs' quicker refueling, longer range, and lighter weight compared to batteries can boost truck uptime, payload capacity, and ultimately improve hydrogen trucks' TCO. TCO is a critical KPI for the fiercely competitive transportation industry.

Based on McKinsey analysis, by 2035, Europe could see as many as 850,000 hydrogen-fueled medium- and heavy-duty trucks on the road, which would require up to 4,800 hydrogen refueling stations. Hydrogen infrastructure is becoming more attractive due to decreasing hydrogen costs and increasing vehicle demand. Operators of hydrogen refueling stations could reach break-even as early as 2025 only by serving a small fleet of trucks.

Hydrogen trucks can also be deployed on a similar scale to diesel trucks but with the advantage of no emissions and a lower long-term operating cost, McKinsey suggested. By 2030, the estimated TCO to operate an HDT traveling 500 km per day will be EUR 1.13 for diesel, EUR 1.03 for battery electric trucks, and EUR 1.02 for fuel cell trucks.

Sources: Statzon, WE Forum, McKinsey (1), McKinsey (2), McKinsey (3), BCG, IEA (1), IEA (2), PWC, World Bank, Interact Analysis (1), Interact Analysis (2), Reuters, TUV Süd, hydrogeninsight.com,