Trucks, which make up the majority of Medium- and Heavy-Duty Vehicles (MHDVs), contribute significantly to air pollution, emitting substances like nitrogen oxides (NOx) and particulate matter. These pollutants have a more significant impact on communities located near highways and industrial areas, which tend to be economically disadvantaged.

In Europe, heavy-duty trucks are responsible for 26% of road transport's greenhouse gas emissions, despite constituting only 2% of the vehicle population. Similarly, in the US, while cars emit the most carbon, MHDVs like trucks are a close second. These vehicles collectively release over 561 million metric tons of carbon dioxide equivalent (CO₂e), about 25% of all transport emissions, despite being only 10% of the vehicles.

This issue is growing as truck emissions have nearly doubled in the past three decades due to the expanding economy and e-commerce. However, the consensus is growing that the zero-emission (ZE) truck industry is making strides in decarbonizing fleets through battery electric vehicles (BEVs) and hydrogen fuel cell electric vehicles (FCEVs) powered by renewable energy.

The transition of the trucking industry to electric drivetrains is inevitable, bringing forth significant opportunities. Major European truck manufacturers like Traton Group, Volvo, and Daimler envision a swift shift to ZE technologies, aiming for at least 50% of new truck sales to be ZE vehicles by 2030.

Global electric truck market value and outlook

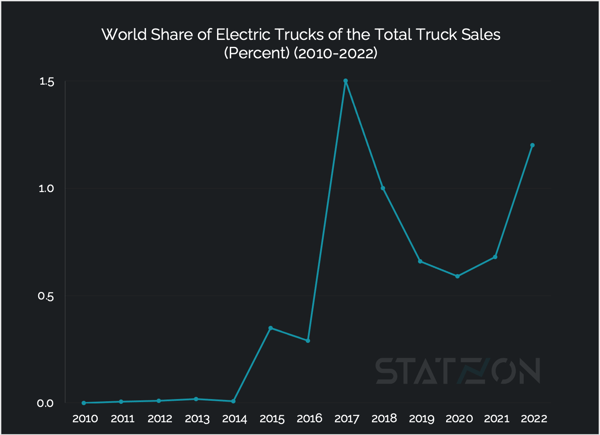

Based on IEA's data, approximately 60,000 medium- and heavy-duty trucks were sold globally in 2022, accounting for 1.2% of total truck sales worldwide. Apollo Research Reports indicate that the electric truck market was valued at USD 1.9 billion in that year and is foreseen to escalate to USD 38.7 billion by 2032. This remarkable growth signifies an impressive projected CAGR of 35.1% during the forecast period spanning from 2023 to 2032.

China continues to maintain its dominance in the production and sales of electric (and fuel cell) trucks and buses. In 2022, China witnessed the sale of 54,000 new electric buses and an estimated 52,000 electric medium- and heavy-duty trucks, accounting for 18% and 4% of total sales within China, and around 80% and 85% of global sales, respectively. Moreover, Chinese brands are significantly present in the bus and truck markets in Latin America, North America, and Europe.

While electric truck sales are on the rise, their market share remains relatively low in most major regions. Except for China, cumulative sales of electric medium- and heavy-duty trucks have reached only a few hundred units in many countries (approximately 2,000 electric trucks were sold across the entire European Union in 2022). Generally, sales shares in the medium- and heavy-duty segments are below 1%, with notable logistics companies utilizing electric trucks for regional and long-haul operations as a demonstration of their capabilities.

Global electric truck market segmentation

Battery-electric truck segment is clearly leading ahead of the hybrid category, accounting for USD 1.6 billion within the overall electric market, representing about 84% of the entire market. This segment is poised to maintain its dominance as the trend toward zero-emission vehicles favors battery-driven options over hybrids. By 2032, the battery electric truck market is projected to expand nearly 20-fold from its 2022 value, reaching a substantial USD 31.7 billion.

While the hybrid electric truck market will also experience notable growth, it will be on a much smaller scale compared to the battery-electric segment. The market value for hybrid trucks in 2022 was USD 390 million and is predicted to rise to USD 6.9 billion by 2032.

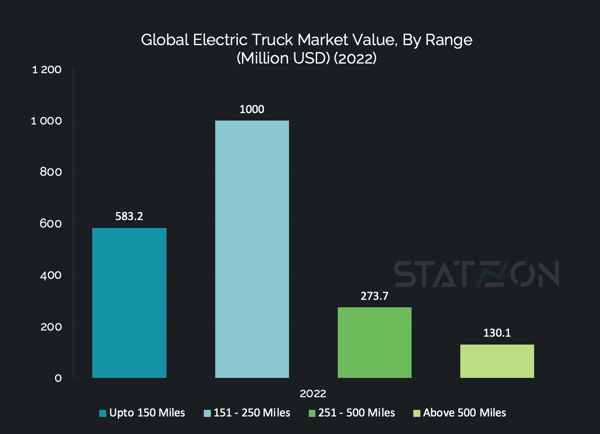

Apollo Research Reports provide further insights into market diversification based on vehicle range categories. Among these, the 151-250 miles range segment stands out as the highest contributor, generating USD 1 billion in 2022, which accounts for over 50% of the total market. This segment's market value is estimated to reach USD 17.9 billion by 2032. The segment comprising trucks with up to 150 miles range follows as the second-largest contributor, contributing over half a billion USD in 2022 and displaying a slightly higher CAGR of 35.86% compared to other segments.

Trucks with a range above 500 miles constitute the smallest segment, comprising less than 7% of the total market in 2022. This segment is projected to remain the smallest throughout the forecast period until 2032.

Source: Statzon/Apollo Research Reports

Source: Statzon/Apollo Research Reports

Significance of hydrogen fuel-cell trucks

Despite the skepticism surrounding fuel cell technology, as highlighted in a study conducted by the Fraunhofer Institute, which predicts a limited role for hydrogen in road transport, there remains a significant contingent that views fuel cells as a practical option, particularly for heavy-duty vehicles tasked with long-haul journeys. The benefits of transitioning heavy-duty vehicles to a low-carbon state, a task often challenging to achieve through electrification, are the very factors that establish hydrogen as a practical fuel option within the realm of commercial transport.

Based on the most recent findings shared by Interact Analysis, an expectation arises that heavy-duty trucks will emerge as the primary sector adopting hydrogen in transportation by 2030. China is leading the way, poised to establish its dominance in the market over the next decade, while Europe is observing a swift surge in adoption rates. A staggering cumulative total of 45,000 heavy-duty hydrogen trucks are projected to be operational across Europe by the year 2030.

Significant strides are already being taken in the development of fuel cell trucks, with major automakers like Mercedes-Benz crafting models boasting a remarkable range of over 1,000 kilometers (approximately 621 miles). Meanwhile, for nearly two-thirds of road freight activities spanning distances of under 400 km, battery electric trucks represent the most competitive technology, swiftly closing in on cost parity with conventional diesel trucks from a comprehensive total cost of ownership (TCO) perspective.

In particular, hydrogen-powered fuel cell electric trucks are poised to excel in the domain of extended journeys and demanding tasks, requiring substantial energy. Furthermore, these hydrogen-fueled trucks present a compelling option in regions grappling with limited battery charging infrastructure, opening avenues for their strategic deployment.

100% zero-emission by 2035 for heavy trucks

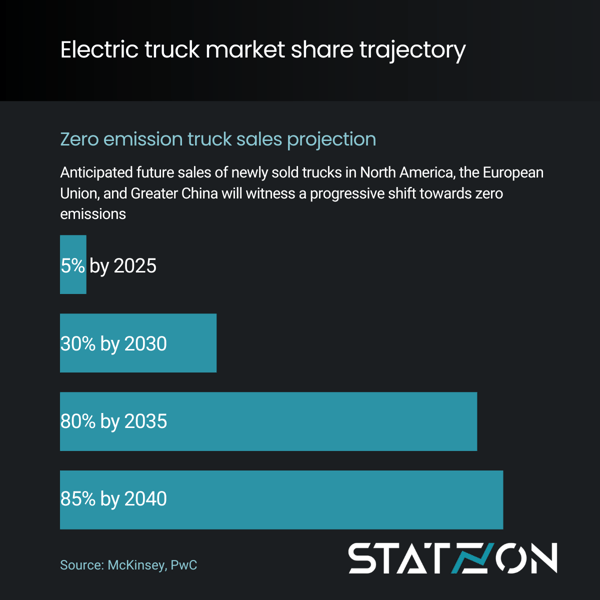

McKinsey's projections indicate that by 2025, about 4% of sales for both medium-duty and heavy-duty trucks in Europe are expected to be zero-emission vehicles. Expanding to a worldwide perspective, it's anticipated that by 2040, 40% of trucks across the United States, Europe, and China will be running on battery electric or fuel-cell technology. Also in 2040, 85% of newly sold trucks across those three regions will be zero-emission.

Similarly, Price Waterhouse's analysis confirms this trajectory, forecasting a parallel trend for North America, the European Union, and Greater China although their analysis doesn't delve into the distinction between battery electric and fuel-cell vehicles. These three regions are foreseen to swiftly transition to electrification, with electric trucks constituting approximately 5% of the market by 2025, achieving a significant 30% milestone by 2030, and ultimately commanding an impressive market share of around 80% by 2035.

While the aspirations for truck electrification are bold, we are still in the early stages of this journey. For instance, Volvo Group, a leading advocate of truck electrification, notably escalated their efforts, delivering a significant increase of fully electric trucks from 371 in 2021 to 1,211 in 2022. Additionally, their order intake surged from 1,062 to 3,633 units during the same period. However, these figures represent only a modest 0.2% and 0.4% of total deliveries and orders, respectively. By the end of 2022, only around 4,000 electric trucks were registered in the EU. This number is projected to grow more than twenty-fold until 2025, reaching almost 600,000 units by 2030

In Europe, by 2035, a CO2 reduction target of 100% should apply to heavy lorries (above 16 tones). The CO2 standards currently only regulate heavy lorries which are responsible for 64% of all emissions from HDVs.

Electric truck TCO parity

Total Cost of Ownership (TCO) is a pivotal factor driving the adoption of zero-emission trucks, particularly for fleet operators who prioritize operational costs over private car buyers. The TCO for zero-emission trucks is projected to decrease significantly, potentially by up to 65% by 2040. This decline is underpinned by three key catalysts.

Advancements in technology, including reductions in battery and fuel cell system costs, as well as more economical refueling infrastructure, will be the first driving force. Additionally, the scale-up of vehicle production will lead to lower per-unit costs for both components and assembly, forming the second contributing factor. The third catalyst is the growing deployment of zero-emission trucks on the roads, which will bring down per-truck charging and refueling infrastructure expenses, ultimately reducing operational costs.

Alternative powertrains translate into additional costs to vehicle ownership, although the cost gap between Battery Electric Trucks (BET) and Fuel Cell Trucks (FCT) compared to Internal Combustion Engine (ICE) vehicles diminishes over time. In Europe, the discrepancy can amount to as much as EUR 90,000 for long-haul BET and FCT by 2030. However, this cost disparity narrows over time.

A study conducted by the Transport & Environment (T&E) already suggests that around 70% of urban delivery trucks are presently more economical to both own and operate compared to their ICE counterparts.

Fuel cell long-haul trucks have the potential to achieve Total Cost of Ownership (TCO) parity with their diesel counterparts by 2030, based on a study conducted in 6 European countries, provided the green hydrogen fuel price at refueling stations is approximately 4 €/kg. Break-even hydrogen prices differ by country due to their specific diesel costs, road tolls, and taxes. A hydrogen fuel subsidy would be required to balance total ownership costs between fuel cell electric trucks and diesel trucks by 2030, with renewable electrolysis-produced hydrogen on-site.

McKinsey forecasts that by 2030, Battery Electric Vehicles (BEVs) and Fuel Cell Electric Vehicles (FCEVs) could match diesel costs in most scenarios and places. In the long run, savings compared to diesel could be substantial, potentially up to 30%, depending on the usage context.

Charging infrastructure for battery-electric trucks

The lack of a robust charging infrastructure system could jeopardize a jurisdiction’s ability to keep up with its zero-emission truck goals.

The consulting firm, Arthur D. Little recognizes at least four different types of charging infrastructure needed to fuel electric trucks.

- Depot Charging: Trucks charge at their home depot, typically overnight. Different charger types (22 kW AC to 150 kW DC) are used based on charging time and truck usage.

- Destination Charging: Trucks charge while stationary, such as during loading/unloading. Urban deliveries have shorter charging opportunities (around 1-2 hours), using 350 kW DC chargers.

- Public Fast Charging: Available at en-route stations, high-powered chargers (1 MW or more) are needed for a quick 45-minute charge, requiring a new plug standard like the Megawatt Charging System.

- Public Overnight Charging: Similar to fast charging, but with longer allowed charging times (at least nine hours) for long-haul applications, using DC 100-150 kW chargers.

The analysis suggests that depot charging will be most common in this decade, especially for early electric trucks on shorter routes. However, as trucks get bigger batteries and handle longer hauls, depot charging's importance decreases. Longer routes will boost public and destination charging needs, and larger batteries will drive demand for more powerful chargers. DC charging tech will become more crucial. Faster charging requires about a full megawatt for a semi-truck, and stations that can simultaneously charge multiple trucks at that power level will be necessary.

Currently, most fast charging stations offer power levels of 250-350 kW. In China, an "ultra ChaoJi" standard is being developed for heavy-duty electric vehicles, aiming for several megawatts. In Europe and the US, the CharIN Megawatt Charging System (MCS) is being developed, potentially reaching 4.5 MW. However, setting up 1 MW chargers will need substantial investment due to high installation and grid upgrade costs.

Price Waterhouse forecasts that a significant investment of around 36 billion euros will be necessary by 2035 to establish a comprehensive charging and hydrogen station network across Europe. To achieve this, the plan involves having at least 2,000 charging stations by 2035, with up to 120-megawatt charging stations already available by 2025, totaling an investment of up to €1 billion.

For the long term, accommodating high demand in Europe requires 1,800 charging parks and an additional 600 pure overnight parks, with a total investment of €36 billion.

In the US, particularly in California, a state accounting for 15% of the US MD/HD vehicle market, more than 157,000 DC fast charging stations will be needed by 2030 to support the increasing adoption of electric MD/HD vehicles.

Charging infrastructure for hydrogen fuel-cell trucks

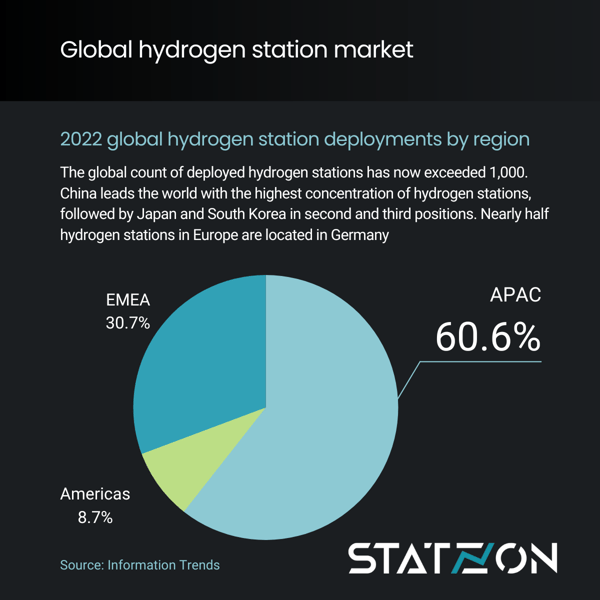

The global count of deployed hydrogen stations has now exceeded 1,000, according to a study by Information Trends. China leads the world with the highest concentration of hydrogen stations, followed by Japan and South Korea in second and third positions. Notably, the Asia-Pacific (APAC) region hosts more than 50% of all hydrogen stations globally.

In contrast, Europe's hydrogen station count, as of the end of 2022, falls below China's total, with nearly half located in Germany. A significant distinction arises: most of Europe's hydrogen stations are not optimized for heavy commercial vehicles, unlike China, where most are designed for refueling trucks and buses.

In recent years, China's infrastructure development has surged forward, driven by substantial investments, while Europe's expansion has been comparably slower. In the United States, California is leading the way with 70 working stations, playing a central role in building hydrogen infrastructure in the country.

Europe just unveiled its first high-pressure hydrogen refueling station for long-haul trucks in June 2023. This achievement comes from a partnership between Air Liquide and Iveco Group. The station, situated in Fos-sur-Mer, France, is a major advancement toward encouraging hydrogen-powered long-distance transportation in Europe.

More insights about electric mobility

Source: Statzon, Electric Truck market report from Apollo Research Reports, Interact Analysis, CNBC, WE Forum, McKinsey (1), McKinsey (2), PwC , IEA, ICF, Arthur D. Little, Information Trends, TÜV SÜD