Robots are invading hospitals like never before, and doctors and healthcare professionals welcome the robots with open hands. In fact, there is an increased reliance on robotics to handle some of the important tasks that need to be done around the hospitals. The existence of medical robots helps medical staff in numerous ways. Robots dispense medicine, fill prescriptions, disinfect rooms, and support people with bodily dysfunctions. But perhaps, the biggest robotic innovation in the medical field is the invention of robotic surgery or surgical robots. These robots have been used to assist surgery since the 1980s for things like holding a patient’s limbs in place, and later for more complex procedures. The use of robotic surgery has become prevalent in recent years.

What is robotic surgery and how does it work?

Robotic surgery, surgical robot, or robot-assisted surgery is the use of robotic instruments, typically robotic arms equipped with high-definition 3D camera to magnify the tissue and structures of the area being operated. A surgeon will control this instrument using hand and foot movement while looking at a monitor. The robotic system will then mimic the surgeon’s movements to make tiny incisions on the patient with great accuracy and precision.

Robotic surgery vs. traditional surgery

Surgical robots are mainly used in minimally invasive surgery as they enable precise manipulation of surgical instruments beyond human ability in a small operation space. Robotic surgery offers better accuracy, precision, dexterity, tremor corrections, and scaled motion that translated into more successful surgeries.

Robotic surgery offers minimal complications and faster recovery time in comparison to traditional open surgery, which requires a larger incision.

Global robotic surgery market outlook

A study from The Insight Partners shows that the global surgical robot market is valued at around USD 6.8 billion in 2021. This number is expected to grow with a CAGR of +14.8% to reach USD 17.6 in 2028. Innovations in the industry are expected to reduce the cost of the systems over the coming years. Thus, market penetration is expected to increase.

Surgical robot market trends and growth are influenced by factors such as:

- The complexity of surgical procedures

- Increased funding for medical robot research

- Cost efficiency in patients’ post-operation rehabilitation

- Growing rates of cardiovascular diseases in American adults

- The aging population and increasing demand for healthcare automation

- Countless robotic advantages, such as heart surgeries that keep the sternum intact

On the contrary, high installation costs, concerns regarding safety and software malfunction, plus requirements for skilled personnel are some of the factors that challenge the market’s growth.

North America still dominates the robotic surgery market

North America has been a long-time leader in the market, pushed by the US who has been pioneering the innovations of surgical robotics since 1980. Many of the major medical robot manufacturers are based in the US and the country is an early adopter of surgical robotic technology. The active participation of academia and collaborations with corporates has also influenced the growth of the region’s market.

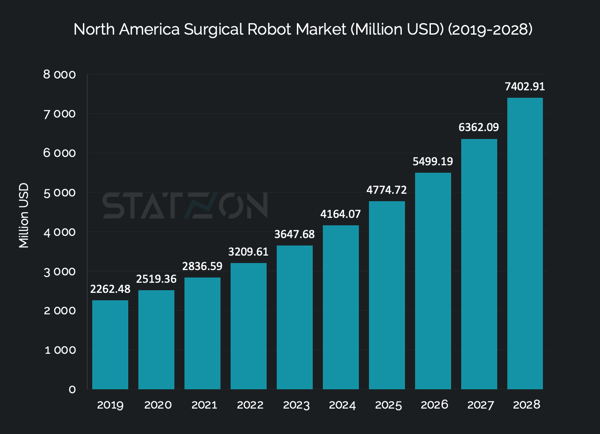

In 2021, the robot-assisted surgical system market in North America reached USD 2.8 billion, roughly 40% of the global market value. The market is predicted to hit USD 7 billion by 2028, registering a 14.9% CAGR. US market alone was valued at USD 2.4 billion in 2021, making it the biggest market in the region, and also the world. US market accounted for 85% of the region’s market, 35% of the global market.

Source: Statzon/ The Insight Partners

Source: Statzon/ The Insight Partners

Europe and Asia Pacific are the other two major markets, each with a 30% and 21% market share in 2021. The market in Asia Pacific is accelerating at a slightly faster pace than the rest of the world with a 15.8% CAGR. The rapid growth is linked to rising demand from key markets, such as China and Japan, the increasing patient pool in India, governments that have begun to cater to advanced healthcare services, and R&D done in collaboration with governments and universities.

China shows the highest market growth among any other countries with a CAGR of 16.5%. China installed 8 da Vinci Surgical Systems in 2018. In 2021, the number of installations exceeded 260 units. The surgical robot market in China is forecasted to grow from USD 399 million in 2021 to USD 1.1 billion by 2028.

Robotic surgical system components, applications & end-users

Robotic surgery components

Based on the product type, surgical instruments & accessories hold the largest share (52%) of the market. They were valued at around USD 3.6 billion in 2021. Robotic systems take up 41% of the market, which is then followed by services (6% of the share). Surgical instruments & accessories are disposable by their nature and utilized extensively in surgical operations. These factors primarily drive the growth in this segment, and thus they are expected to hold a firm market dominance.

Robotic surgery applications

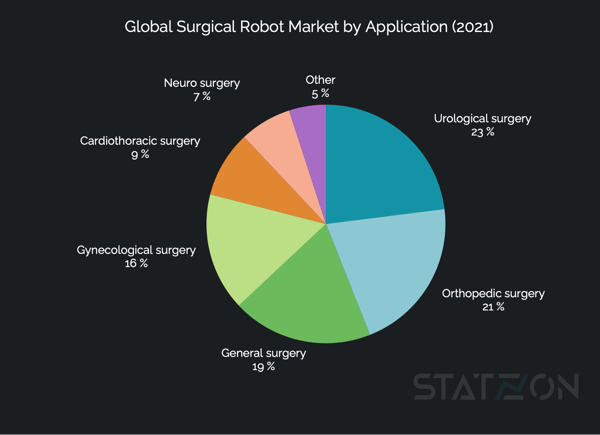

Based on application, the market is segmented into general surgery (19% market share), gynecological surgery (16%), urological surgery (23%), orthopedic surgery (21%), cardiothoracic surgery (9%), neurosurgery (7%), and other applications (5%).

Source: Statzon/ The Insight Partners

The surgical robot market for urological procedures was valued at around USD 1.6 billion in 2021 and will grow to USD 4.3 billion in 2028. Robotic urological surgery can be used to treat several diseases and conditions, including prostate cancer, kidney cancer, kidney obstruction as well as kidney, ureter, and bladder reconstruction. A robotic prostatectomy operation, for instance, allows a surgeon to safely remove a cancerous prostate while avoiding nerves and muscles surrounding it. The benefits to patients include experiencing significantly less pain and blood loss and quicker recovery times. The robot-assisted prostatectomy, for example, requires 2-3 weeks to recover from traditional “open surgery” recovery time meanwhile may last for two months.

The use of robotics technology for orthopedic surgery is gaining momentum, leading to higher demand for surgical robots catering to orthopedic procedures. Around 11% of knee reconstruction surgeries in 2020 involved robotic assistance, and it is predicted that the number of such surgeries will increase to approximately 700,000 worldwide by 2030. The Insight Partners estimated the market value for orthopedic surgical robot at USD 1.4 billion in 2021 and is expected to reach USD 2.9 billion by 2028.

Robotic surgery end-users

Based on end-users, the robotic surgery market is fragmented into hospitals and ambulatory surgical centers. Hospitals dominate the end-user segment with 65% share of the market and revenue worth around 4.4 billion USD. This leaves 29% of the market to ambulatory surgical centers and the rest 6% to other kinds of facilities such as research institutes and specialty clinics.

The popular da Vinci Robotic Surgical Systems

It is impossible to talk about robotic surgery without mentioning the da Vinci Surgical System. It is by far the most popular robotic surgical system in the world, even with its high price tag of around USD 2 million. There are more or less 7000 of these robots globally, performing 10 million surgeries so far.

da Vinci Surgical System is the star product of the robotic manufacturer, Intuitive Surgical. The robotic system uses a minimally invasive approach for numerous surgical procedures, mostly for hysterectomies and prostate removals. Approval has also been given for uses of the system in other procedures, such as general laparoscopic surgery, thoracoscopic (chest) surgery, laparoscopic radical prostatectomies, and thoracoscopically-assisted heart procedures.

da Vinci Systems has been dominating the surgical robotic market since it received its FDA clearance in 2000 and became the first robotic surgical platform commercially available in the United States, and later, the world. But competition is coming as patents for the system started to expire a few years ago. Similar, more affordable systems are expected to enter the market.

Leading surgical robot companies

Intuitive Surgical has been dominating the robotic surgery market for around 20 years with a customer ecosystem that is hard to break by other companies. As per 2018 data, Intuitive Surgical is controlling 55% of the market. Still, competition exists for them. As a young company focusing only on manufacturing surgical robots, Intuitive Surgical faces competition from much larger companies that have been in the medical field for a long time with a wide range of offerings in their portfolio.

Some of the major competitors manage to become key players in the surgical robot market, such as Stryker Corporation, Medtronic, Zimmer Biomet Holdings, and Smith & Nephew.

Stryker Corporation

Revenue: USD 18.4 billion (2022), a 7.84% increase from 2021.

Founded in 1946 in Michigan, US, Stryker is the largest medical robotics company in the world. This is the company that produces Mako robotic surgery platform, a robotic-arm famous for its ability to perform high-precision knee replacement surgeries. Sales for this robot were up by 19% in 2022 compared to the previous year.

Stryker manufactures an extensive range of medical equipment, covering orthopedic implants, sports medicine, trauma and extremities products, rehabilitation products, and neurotechnology products, in addition to its robotics line. Stryker’s presence spans over 100 countries worldwide, including Europe, Asia, and the Middle East.

Medtronic

Revenue: USD 31.6 billion (2022), a 5.21% increase from 2021.

Medtronic Plc is one of the biggest medical device companies in the world. With operations in over 150 countries, foreign sales generate nearly 50% of the total sales. The company acquired Mazor Robotics Ltd., an Israel-based spine surgery innovator, in 2018, and Digital Surgery, a London-based surgical A.I. company, in 2020. Medtronic (MDT) is traded on NYSE.

The four core business units of Medtronic consist of: the minimally invasive therapies group, the diabetes group, the restorative therapies group, and the cardiac and vascular group. The company’s wide selection of products treats 70 health conditions, including cardiac devices, insulin pumps, surgical tools, and patient monitoring systems.

Medtronic currently offers the Mazor X Stealth Edition robotic guidance platform for spinal surgery, which was co-developed with the previously acquired Mazor Robotics. The platform consists of features such as customizable implant selection, optimal implant trajectories, and 3D analytics.

In 2021, Medtronic launched its robotic-assisted platform Hugo RAS Surgery System that is meant to rival Intuitive Surgical’s da Vinci robots. Hugo has four independent arms that allow for greater access to the abdomen in comparison to the da Vinci system.

Zimmer Biomet

Revenue: USD 6.9 billion (2022), an 11.4% decline from 2021

Zimmer Biomet Holdings, Inc. designs and manufactures orthopedic reconstructive implants, along with supplies and surgical equipment for orthopedic surgery. More than half of the company’s revenue is generated from the sales of large joints, and an estimated 20% accounts for trauma & extremities, with the remaining sales mostly related to spine and dental products. Zimmer Biomet (ZMH) is traded on NYSE.

The company’s robotic solution, ROSA One, was designed to be surgeon-centric, accurate, and consistent. The ROSA Knee System is used to perform Total Knee Arthroplasty (TKA). The assisting features include bone resections, assessing soft tissues, and facilitating implant positioning.

The ROSA ONE Brain application is a dual platform offering both brain and spine modalities in one system, decreasing tech acquisition costs. It is used to assist in diverse neurosurgical procedures, such as stereo electroencephalography (SEEG), deep brain stimulation (DBS), stereotactic biopsy, as well as in ventricular and transnasal endoscopy.

Smith & Nephew

Revenue: USD 5.2 billion (2021), a 14.3% increase from 2020

Smith & Nephew plc is a designer and manufacturer of orthopedic devices, sports medicine, ENT technologies, and wound-care solutions. Approximately half of the company’s total revenue comes from the USA, around 30% is from other developed markets, and emerging markets account for the remainder. Smith & Nephew (SN) is traded on the London Stock Exchange.

The company offers two types of handheld robotics: the NAVIO and CORI surgical platforms. They are both small and portable, hence ideal for ambulatory surgery centers.

2020 launched CORI platform is intended for knee & total knee arthroplasty. CORI comes with new camera tech (over four times faster than the older NAVIO platform) and offers more efficient cutting tech (twice the cutting volume).

CORI’s handheld milling technique uses two control modes: exposure and speed control, which automatically adjust to execute patient-specific plans. The enhanced robotic software delivers image-free smart mapping of bone and cartilage. The software does not require C.T. or MRI.

Intuitive Surgical

Revenue: USD 6.2 billion (2022), an 8.97% increase from 2021.

Intuitive Surgical, Inc. is a developer, producer, and marketer of a robotic system that assists in minimally invasive surgeries (MIS). The company also provides disposable accessories, instrumentation, and warranty services for the system. Intuitive Surgical (ISRG) is traded on Nasdaq-GS.

There are more than 6000 da Vinci Systems available in hospitals worldwide.

Intuitive Surgical offers three surgical system models to choose from:

- Da Vinci Xi features the most advanced instrumentation, vision, and incorporated table motion.

- Da Vinci X is the cost-conscious choice with Xi-model’s architecture.

- Da Vinci SP for narrow access surgery, with a single arm equipped with multi-articulated instruments and a 3DHD camera.

All three systems share the following components that vary depending on the model: a patient cart, a surgeon console, and a vision cart.

Sources: Statzon, Science Direct, Macrotrends, TRENDS in Urology and Men’s Health publication

Robotics market guide: The ultimate guide to the ever-evolving robotics marketStatzon's Handbook of Robotics is your ultimate guide to understanding the ever-evolving robotics market and its impact on various industries worldwide. Robotics has been one of the fastest-growing industries in recent years, transforming how we live and work. From manufacturing and healthcare to agriculture and retail, robots are changing the face of businesses and revolutionizing how we approach various tasks. With so much potential and opportunity, staying up to date with the latest trends and insights in the global robot market is essential. This handbook provides a comprehensive market overview, including key players, emerging technologies, and prospects. |