Businesses have once again placed a top priority on costs, efficiency, and resilience because of the current uncertain situation that leads to labor shortages, inflation, and a recession. Through automation, organizations can achieve greater efficiency in multiple areas. Businesses that previously showed resistance finally turned to automation during the COVID-19 pandemic to cope with the sudden shrinking of labor forces.

Global Factory Automation Market Value

The Market Research Future estimates the value of the factory automation market was USD 140.5 billion at the end of 2023. The company forecasted the market to grow to USD 281.9 billion by 2030, registering a CAGR of 9.1% during the forecast period 2022-2030.

The trend of automation is long-term. The world is facing a major demographic shift which leads to a stagnant or declining growth of the labor force. Three historical momentums that boosted the size of available labor have already faced their end of time, namely: the coming of age of the baby boomer generation, women's entry into the workforce, and the integration of China and India into the global economy. With a slow global birth rate and a growing aging population, the era of plentiful labor is over.

Regional Analysis of the Factory Automation Market

Despite the relatively larger labor force compared to other regions, Asia-Pacific is dominating the market with a 43.4% share in 2023, based on research by Market Research Future. Automation brings forth speed and accuracy beyond human capability. The region is growing at 9.7% CAGR, the highest CAGR among other regions.

China and India are the fastest-growing economies in Asia-Pacific. Manufacturing automation has been growing well in these two countries during the last decade. Though the Chinese manufacturing industry has been hit hard due to the prolonged lockdowns, it is still doing relatively well when compared to the global manufacturing economy. The projection for the next few years is showing growth. Taiwan, Thailand, and Indonesia are emerging markets that are on the brink of an industrialization boom that will encourage the factory automation market to grow further.

Europe is the second largest market regulating 28.7% of the market. Growing demand for processed food in the food processing industry has been positively impacting the factory automation market in this region. Germany and the UK are the highest contributors to the European market thanks to several automotive and aerospace companies located in these two countries, such as ABB, Schneider Electric, and Siemens.

Other regions in the factory automation market are North America, with a 20% market share, the Middle East & Africa (4.4%), and South America (3.5%) in 2023.

Key Technologies in Factory Automation

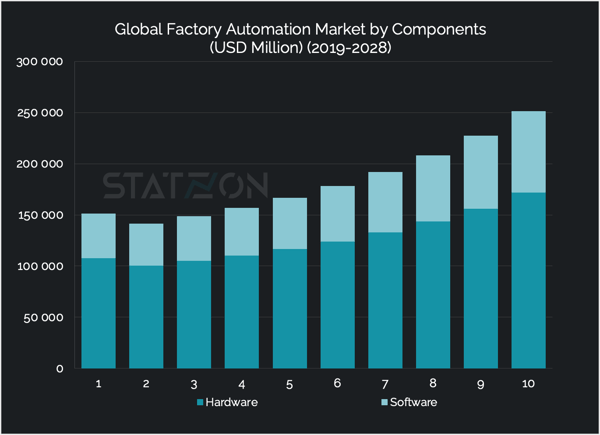

Factory automation market by component.

The factory automation market based on components is segmented into hardware and software. The hardware segment dominates the market mainly due to the rapid adoption of robots by many industries. Sensors, controllers, drives, communication infrastructure, switches and relays, and timers are also part of the hardware segment. Total revenue brought by this segment is estimated to reach USD 114 billion by the end of 2023, accounting for 69% of the total factory automation market.

The hardware market is dominated by the robot sub-segment which accounts for 38% share of the total hardware market in 2023. Controller and sensors are the second and third biggest sub-segment, each contributing 19.6% and 18% share for the hardware segment.

The hardware segment grows at an 8.16% CAGR to reach USD 169 billion by 2028. However, the software segment is expected to grow at a higher CAGR over the forecast period.

The factory automation market for the software segment is expected to reach a revenue of USD 50 billion in 2023 and is projected to grow at 9.7% CAGR during the forecast period to reach USD 79.6 billion by 2028.

Source: Statzon/ The Insight Partners

Source: Statzon/ The Insight Partners

Factory automation market by type of factory automation

Based on the type of automation, The Insight Partners describes the market using three different segments, in which the Fixed Automation segment is dominating the market with a 42% market share. The estimated revenue for this segment is USD 68.5 billion for the year 2023. High initial investment and high production rates characterize this form of automation. It is, therefore, suitable for products that are made in large volumes.

The second most favorable type of automation is Programmable Automation which will account for 31% of the total market in 2023. The estimated 2023 revenue for this segment is around USD 51 billion. This type of automation allows for easy adjustments when changing the order of operations. Programmable automation is most used in systems that produce similar items using the same automated steps and tools. It's ideal for medium-to-high production volumes and suitable for batch production processes. It takes time to complete this reprogramming and switchover, and there is a production run for each new product, followed by a period of inactivity batch. Programmable automation often has lower production rates than fixed automation as the machines have to be set in the required product specification of every batch, thereby increasing the machine downtime.

The third type of automation, Flexible Automation, is estimated to gain USD 45 billion in revenue in 2023, or around 27% share of the market. This type of automation is an extension of programmable automation, designed to quickly adapt and respond to product changes in terms of quantity and type with zero or minimal downtime. It is suitable for companies delivering batches of different products with low-to-medium output.

Factory automation market by technology

Based on the technology offered, there are six segments describing the market. Market share for each segment is:

Supervisory Control and Data Acquisition (SCADA) - 29%

Programmable Logic Controller (PLC) - 14%

Distributed Control System (DCS) - 18%

Human Machine Interface (HMI) - 15%

Others - 24%

The Other segment includes technology such as Machine Vision Systems, Plant Asset Management, CNCs, Robotics, Industrial 3D Printing, Digital Twin, Machine Condition Monitoring, Manufacturing Execution Systems (MES), CAD/CAM software tools, and ERP Software.

SCADA is the biggest segment in the market, contributing an estimated revenue of USD 47.6 billion for the year 2023. The growing adoption of Industry 4.0 by many industries has been driving the growth of SCADA market.

End-users of Factory Automation

The factory automation market is divided into different industrial verticals, including automotive, food and beverages, oil and gas, manufacturing, mining, and others.

In 2023, the manufacturing industry holds the largest market share, accounting for 25% of the total market share. By the end of 2023, the market value of this segment is estimated to be around USD 40.6 billion, and it is expected to reach USD 62.5 billion by 2028, growing at a CAGR of 9%.

The automotive segment is the next significant contributor to the factory automation market. It is projected to generate an estimated revenue of USD 38.3 billion in 2023, which is expected to increase to USD 63.3 billion by 2028. The automotive industry is poised to play a vital role in driving the growth of the factory automation market, primarily due to the extensive utilization of industrial robotic technology for manufacturing automotive parts.

The food and beverage industry represents the third largest market for factory automation, comprising approximately 19% of the market share. It is anticipated to generate an estimated revenue of USD 38.8 billion in 2023, with a projected revenue of USD 63.2 billion by 2028.

Leading Companies in Factory Automation

The Insight Partners recognizes Emerson Electric, Schneider, ABB, Siemens AG, and Honeywell as the top five key players in the global factory automation market. The listing is based on several parameters such as overall revenue, segmental revenue, brand image, industry experience, current product portfolio, innovative and advanced technology integration/enhancements, customer base, geographical reach, new product launches, partnerships, mergers & acquisitions, and other market related activities.

The top five players are also focusing on acquiring new start-up companies to retain their position in the global factory automation market which is also enabling these vendors to increase their geographical foothold in the marketplace.

Sources: Statzon, Bain & Company, World Economic Forum, Interact Analysis

_(2018-2030).png?width=600&height=331&name=chart_global_factory_automation_market_size_(usd_million)_(2018-2030).png)