As we step into 2024, major markets including Europe, the United States, and China will continue their steadfast transition to electric mobility, building upon the successful and steady acceleration witnessed in recent years. Other global markets are also expected to follow suit, embracing the shift towards electric vehicles. This year is set to be a defining moment for the EV industry, spotlighting a range of promising trends and forecasts that are shaping the future of transportation worldwide.

Connectivity

The advancement of connectivity and digitalization in the automotive industry is shaping up to be a key trend, holding significant potential to influence consumer preferences and driving experiences. According to a 2021 McKinsey study, Chinese consumers are particularly receptive to these features, willing to pay twice as much as their Western counterparts for connected car technologies. This trend suggests that while electrification might become a standard expectation, the real game-changer could be the consumer-friendly, connected features of vehicles. In China, for example, 56% of consumers expressed a willingness to switch car brands for better connectivity.

Further highlighting the importance of connectivity, a 2023 survey by The Bureau of Energy Efficiency (BEE) found that 85% of electric two-wheeler users appreciated IoT features for enhancing their daily commutes. Smart mobility solutions, integrating data from GPS, traffic cameras, and weather forecasts, are set to streamline travel by providing efficient routes, reducing travel time and road congestion.

Vehicle-to-vehicle (V2V) communication is another aspect of this connected landscape. It allows cars to share information about speed, position, and direction, enhancing safety through early collision warnings and supporting autonomous driving features. In emergency situations, V2V communication can play a crucial role in preventing accidents and saving lives.

Digitalization and Display

The latest cars are increasingly catering to the digitally-savvy driver, with vehicle interiors transforming into digital hubs, akin to "smartphones on wheels." This transformation is evident in the reduction of hard keys, the introduction of larger displays, and an enhanced focus on the passenger experience. Car manufacturers and suppliers are exploring various methods to display information within the vehicle, ranging from dashboard-spanning displays to tablet-like screens in various orientations. The role of hardware in providing a digital experience is growing, but the software powering these systems is becoming equally crucial.

In 2024, expect to see electric vehicles (EVs) seamlessly woven into broader smart ecosystems. They'll communicate with smart home devices and smartphones, offering real-time updates on traffic and weather. This trend of digitalization is not just about integrating advanced technology; it's about reshaping the driving experience to mirror the convenience and interconnectedness we've become accustomed to in our digital lives.

Used Cars Electrification

As electric vehicle (EV) sales begin to stabilize, especially in early adoption markets, the role of used EVs in boosting the transition to greener transportation modes becomes increasingly prominent. The initial surge in EV demand was largely driven by the anticipation of the end of subsidies and incentives, particularly for orders placed for electric cars in 2021 and 2022. Markets like Norway, known for their early adoption of battery electric vehicles (BEVs), are now witnessing a clear increase in used car sales activities. As many early adopters are now opting for newer, more technologically advanced EVs, increasing the availability of used EVs in the market. This trend is creating a vibrant second-hand EV market, offering more affordable options for those interested in electric mobility but deterred by the cost of new models.

Countries like the US are actively encouraging the shift to electric vehicles (EVs) by making the used car market more appealing. The U.S. Inflation Reduction Act is a key example of this, offering credits that significantly reduce the cost of acquiring a new or used EV. By focusing on both new and second-hand EV markets, the Act catalyzes the expansion of EV adoption, tapping into the considerable potential of the used vehicle sector to drive forward sustainable transportation. This is particularly impactful given that in the U.S., the used vehicle market constitutes a significant portion of the automotive sector, representing about 65 percent of annual passenger vehicle sales and leases.

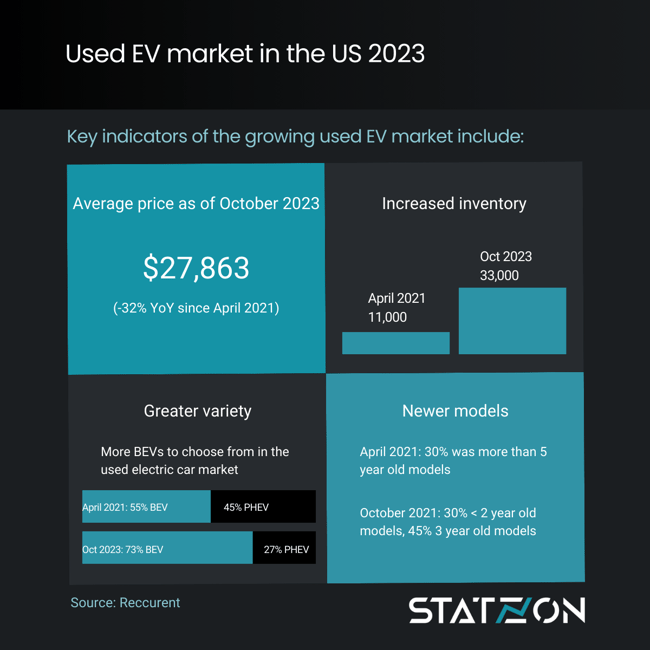

The average price of a used electric car in the US according to Reccurent's price index is USD 27,863 - the lowest since 2021, reflecting a significant 32% YoY reduction. This price reduction is accompanied by key developments in the used EV market, including a substantial increase in available inventory and a shift towards a greater proportion of BEVs compared to plug-in hybrids (PHEVs).

Influx of Chinese EVs

Predictions of an influx of Chinese BEVs into Europe have been around for quite some time. As China's electric vehicles become increasingly affordable, the opposite trend is happening in Europe and the US with EV prices on the rise. This difference in pricing dynamics makes Chinese EVs particularly appealing in the European market. Europe's situation is unique compared to the U.S., where the Biden administration's tax credits for EVs are contingent on North American-made battery components, an incentive absent in Europe. Additionally, Mexico is emerging as a strategic location for Chinese EV manufacturers, reflecting their growing influence in the global EV market.

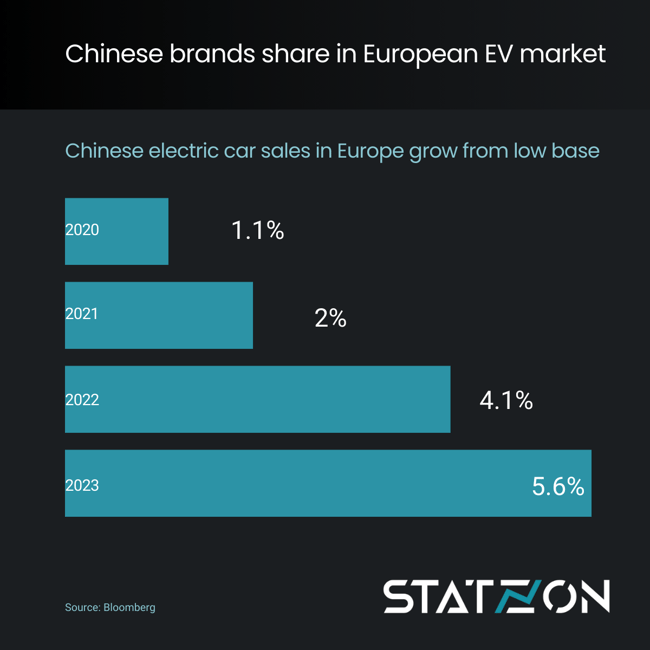

China's expansion in the European car market has been both rapid and significant. As of September 2023, Chinese brands represented nearly 4% of the EU's battery-electric vehicle sales, a dramatic rise from just 0.4% three years prior, according to ACEA. This surge is especially evident in the pure battery electric car sector. By September 2023, Chinese manufacturers had sold 86,000 battery electric vehicles in Europe, almost equalling their total sales for the entire previous year. When hybrid vehicles are taken into account, the market share of Chinese brands in Europe rises to 5.6%, encompassing both pure electric and hybrid vehicles. This marks a significant increase from a modest 1.1% in 2020, as per data from Bloomberg.

The appeal of China’s EVs is not limited to pricing; they also compete in terms of quality and performance. For instance, China can produce electric cars with substantial horsepower at a more affordable price than the European average. An example is the BYD Seal, a midsize sedan with 204 hp, offered in China at a price comparable to the Renault Twingo Equilibre in Europe.

The Shift to Cheaper Batteries

The automotive industry's shift towards more cost-effective EV batteries in 2024 is set to be a pivotal factor in making electric vehicles more accessible to the mass market. Lithium Iron Phosphate (LFP) batteries are gaining traction due to their lower production costs and the scarcity of cobalt, a key component in lithium-ion batteries. This shift plays a key role in helping EV firms continue cutting prices and developing more attractive pricing strategies for the mass market.

Lithium-ion batteries, particularly those using nickel, cobalt, and manganese (NMC) or aluminum (NCA), have been the mainstay for EVs due to their high performance and range. However, LFP batteries are now emerging as a viable alternative. In the Chinese market, LFP batteries are already predominant, and their adoption is beginning to increase in North America and Europe.

Market leaders like Tesla and BYD are pivoting towards these less expensive battery technologies. Tesla already announced in October 2021 that it was switching to LFP batteries for its standard range models, both Model 3 and Model Y. While it still relies on nickel-based chemistries (predominantly NCA) for its high-range and performance models, Tesla's shift to LFP, including its plans to incorporate these batteries in its future semi-trucks and buses, marks a significant change.

BYD is also making significant strides by developing sodium-ion batteries, offering a more budget-friendly alternative to traditional lithium batteries. Moreover, the German luxury car brand has set a 2024 target to start adopting LFP batteries, with BMW following suit by investing in LFP technology for a 2025 release.

Ford is not far behind in this trend, with plans to equip the 2024 Mustang Mach-E with LFP packs, expanding on the usage seen in some of its Standard Range models. NIO is also part of this movement, having recently introduced an LFP battery pack option for its ES6 and ES8 models.

General Motors (GM) is joining the shift with plans to incorporate LFP packs in the updated Bolt EV. Similarly, Hyundai Motor Group is actively developing its own cost-effective LFP batteries, aiming to lessen its reliance on batteries made in China. Hyundai anticipates completing its LFP battery development by 2024 and plans to implement them in various vehicles, including small and entry-level electric cars and mid-priced EVs, starting in 2025.

Source: Forbes (1), Forbes (2), autovista24, AutoEXPRESS, McKinsey, Korea Herald, Euromonitor, Bloomberg, Recurrent