Global EV Market 2023

In 2023, the global market for electric vehicles (EVs) saw an expansion, reaching 14.2 million new deliveries of Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), a 35% increase from the previous year but slower than the 55% rise in 2022.

Out of these, 10 million were BEVs, while 4.2 million included PHEVs and Range Extender EVs (EREVs).

China remained the largest EV market worldwide, with sales topping two million in Q4 of 2023 alone. However, China's BEV growth decelerated to 24%, a sharp drop from 172% in 2021 and 85% in 2022, mainly due to an economic slowdown.

The US and Canada saw significant BEV growth, with a 46% year-on-year increase. Notably, the US crossed the threshold of 1 million BEVs sold by the end of 2023.

Yet, not every region saw positive trends. Germany, at the forefront of Europe's EV market, witnessed a fall in sales and market share, attributed to major cuts in EV incentives, contrasting with the steady increases in other areas throughout the year.

Beyond these major markets, EV sales in other regions jumped by 81%, starting from a smaller base.

Europe EV Sales 2023

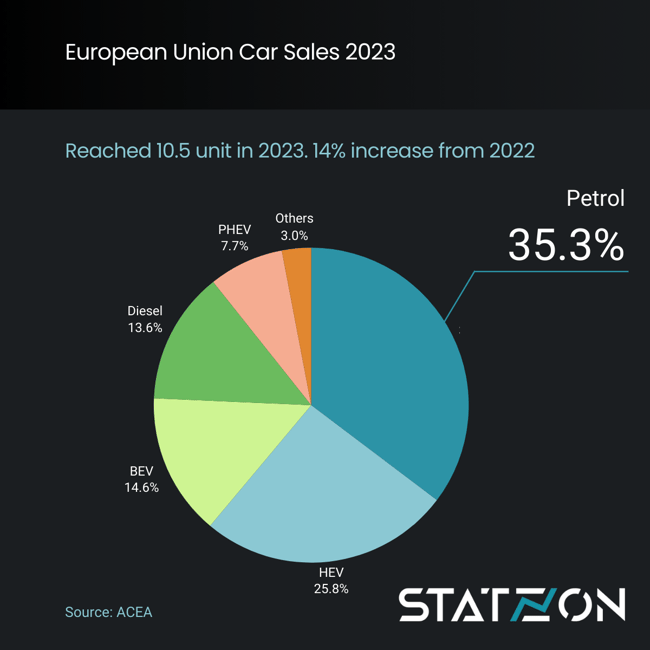

2023 was a good year for the car industry in Europe, with the European Automobile Manufacturers Association (ACEA) reporting that car sales in the European Union increased by almost 14%, reaching over 10.5 million new registrations. This was the highest number of new car registrations in Europe since before the pandemic.

In 2023, battery-electric (BEV) models became the third most popular type of car for buyers, overtaking diesel cars for the first time. BEV sales increased by 37%, taking up a 14.6% market share (up from 12.1% in 2022) with over 1.5 million units sold during the year. By 2025, BEV sales are expected to surpass those of ICE vehicles in Europe.

Meanwhile, Plug-in Hybrid Electric Vehicles (PHEVs) had a 7.7% market share (down from 9.4% in 2022).

The ratio of BEV to PHEV sales shows how the electric vehicle market is changing. BEVs made up 67% of all EV (BEV + PHEV) sales, while PHEVs made up 33%, showing a decrease in the popularity of plug-in hybrids. This change is more noticeable compared to the previous years; PHEVs accounted for 46% of the plug-in market in 2021, which fell to 39% in 2022 and then to 33% in 2023.

The cumulative stock of electric vehicles in the EU reflects this growth, with BEVs reaching a total of 4.7 million units and PHEVs at 3.4 million units.

Despite the overall positive trajectory, December 2023 presented significant challenges, particularly in Germany, Europe's largest car market. A dramatic decrease in EV sales occurred, led by a sharp reduction in new electric vehicle registrations, marking the first downturn in new EV sales in the EU since early 2020. The sudden cut in EV subsidies in Germany, just two weeks before the year's end, led to a near standstill in sales as consumers and dealers navigated the new landscape.

As a consequence, December saw a historic decline in Europe's passenger plugin electric car market, recording only 294,200 registrations compared to 413,500 in the same month the previous year. This 29% year-on-year drop represents the most severe decline witnessed in over a decade, affecting sales of both plugin hybrid and battery electric vehicles.

Nevertheless, 2023 ended with higher sales than the previous year. To overcome the drop in December, many car makers cut prices and offered other incentives, which helped sales start to increase again by January.

Europe Best-Selling Electric Cars 2023

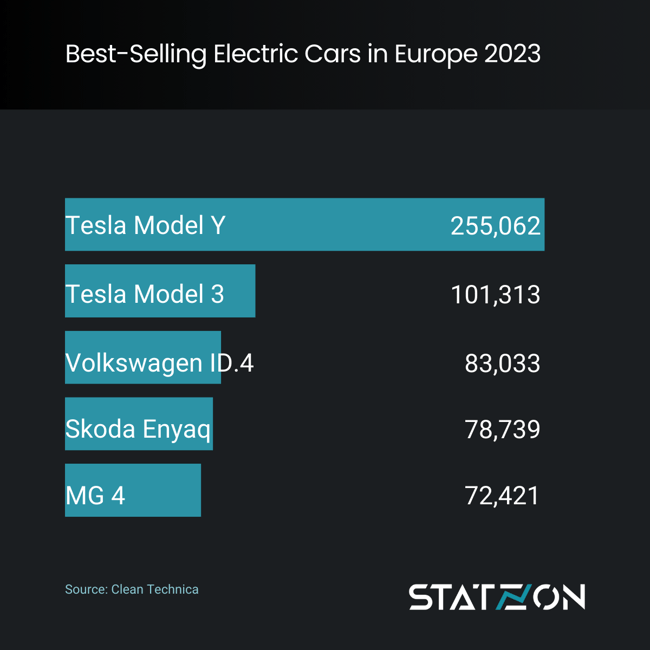

Tesla has made a significant impression on Europe's electric vehicle market in 2023, with the Model Y leading as the best-selling car. It not only topped electric vehicle sales but also overtook all car categories to become the best-selling car overall in Europe, with registrations exceeding 250,000 units, based on data by Clean Technica. This signifies the first time an electric model, especially one from a non-European make, has led the European car sales.

Tesla Model 3 came in as the second most popular electric vehicle in Europe, with sales reaching approximately 101,000 units. Tesla dominated various European markets in 2023 as the company is evidently the main driver behind a continuous increase in electric vehicle market share on the continent. The significant price cuts introduced by Tesla at the beginning of 2023 played a crucial role in boosting the sales of both models, maintaining their momentum into the current year. Tesla dominated various European markets in 2023 as the company is evidently the main driver behind a continuous increase in electric vehicle market share on the continent.

Volkswagen's ID.4 trailed as the third best-selling electric model, with over 83,000 units sold, while Skoda’s Enyaq and the Volvo XC40 (which combines BEV and PHEV sales) were also among the top choices, with 78,739 and 73,650 units sold respectively. Coming in next, the MG 4 saw over 72,000 units sold and the Audi Q4 was close behind with sales nearing 70,000 units.

Meanwhile, the Ford Kuga emerged as the top-selling PHEV in Europe last year, achieving sales of over 52,000 units, with the Volvo XC40 PHEV coming in second, having sold more than 28,000 units.

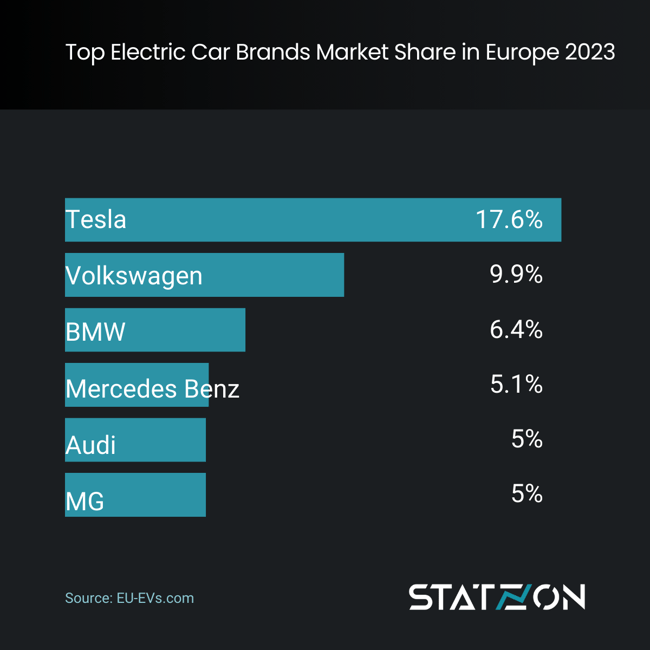

In terms of brands’ market share, Tesla's dominance is further emphasized. The automaker claimed 17.6% of the market, overshadowing Volkswagen's 9.9% share. BMW came in third with 6.4% followed by Mercedez-Benz, Audi, and MG, each with a 5% market share.

Which Countries in Europe Have the Most Electric Cars?

Germany, France, and the United Kingdom consistently rank as the top three EV markets in Europe.

Germany leads the pack, despite the government ending its electric car subsidy program in December 2023. This cessation led to a loss of up to 3,000 euros in government incentives per vehicle and a significant 47.6% drop in EV sales from the previous December. Nevertheless, BEV adoption in Germany continued to grow, with a 12% increase from 2022 and BEVs capturing an 18.3% market share—though PHEV saw a decrease from 13.6% to 6.2% market share. In 2023, Germany registered over 520,000 BEVs and 173,000 PHEVs, bringing the total to 1.4 million BEVs and 1 million PHEVs on German roads.

In France, BEV sales jumped by 46% and PHEV sales by 28% in 2023, with the total electric vehicle market growing by 39%. Registration data for 2023 indicates nearly 700,000 new BEVs and 170,000 new PHEVs. Overall, France has the second-largest fleet of electric vehicles in Europe, with 1 million BEVs and 570,000 PHEVs.

The UK holds the third spot, nearing 1 million BEVs and approximately 560,000 PHEVs. The UK has implemented the new Zero-Emission Vehicle (ZEV) Mandate starting in 2024, which requires car manufacturers to sell a certain percentage of zero-emission vehicles, starting at 22% of new registrations in 2024 and increasing annually to 80% by 2030 and 100% by 2035. In 2023, the UK saw a 17.8% year-on-year increase in BEV registrations, totaling over 314,000 units, while PHEVs expanded their market share from 6.3% in 2022 to 7.4% in 2023, with more than 142,000 new registrations.

And then, of course, there's Norway, a country renowned for its successful penetration of electric cars.

In 2023, the country saw a 27.2% reduction in its overall passenger car market from the year prior. Of the 126,953 new passenger cars registered, 103,946 were BEVs and 10,169 were plug-in hybrids (PHEVs), making BEVs 82% of all car registrations in Norway—the highest rate globally. Despite the downturn, the BEV segment witnessed a slightly smaller decrease of 24.4%, and PHEV sales dropped by 25%, reflecting a significant downturn in Norway's automotive market.

Norway ranks fourth as countries with the most electric cars in Europe with 103,000 registrations for BEV and 10,000 for PHEV in 2023. The accumulative stock of BEV in Norway is 710,000 and 190,000 for PHEVs.

Top 6 countries with the highest market share for pure electric car registrations in 2023 in Europe are Norway (81.8%), Iceland (57.9), Sweden (38.3%), Denmark (36.2%), Finland (33.9%), and the Netherlands (30.52%), followed by Austria (19.9), Belgium (19.6%), Germany (18.2), and UK (16.5%).

Public Charging Station Availability

In Europe, the majority of EV charging happens at homes or workplaces, which represent 70% of charging activities. These locations generally offer lower power outputs and require more time to charge, making them the most cost-effective options for EV owners. This presents a challenge in accommodating the 46% of EU residents living in apartments, hence the need for accessible public charging infrastructure.

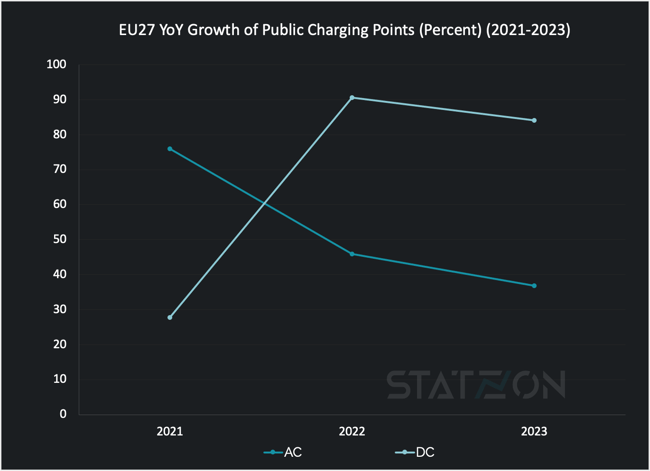

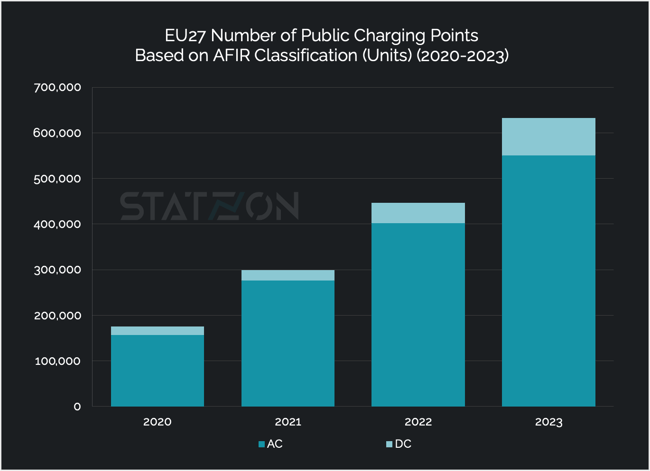

Growth in Europe's public EV charging sector, while faster than many regions, has experienced a deceleration. The installation of AC chargers in Europe increased by 46% in 2022, down from 76% the previous year, and slowed further to 37% growth in 2023. DC chargers also saw high growth rates, at 90% in 2022 and 84% in 2023.

Source: European Alternative Fuels Observatory (EAFO)

Source: European Alternative Fuels Observatory (EAFO)

By the end of 2023, the European Union boasted over 630,000 public charging points according to the European Alternative Fuel Observatory (EAFO), with DC chargers making up 13% and AC chargers 87%. This is a considerable increase from the 7% share of DC chargers at the end of 2021.

Source: European Alternative Fuels Observatory (EAFO)

Source: European Alternative Fuels Observatory (EAFO)

The High-Power Charging (HPC) network is essential for facilitating EV adoption across Europe. Under the Alternative Fuels Infrastructure Regulation (AFIR), ultra-fast charging stations are categorized by their output levels: Level 1 offers 150 kW to less than 350 kW, while Level 2 provides 350 kW or more, enabling the quickest charging times.

HPC stations account for 7% of all public charging points within the EU27. This percentage rises to 8% when including the wider European region. Norway leads in the HPC ratio with 25%, followed by Finland and Estonia at 16%, Germany at 13%, and Austria at 11%. Latvia, Croatia, Iceland, Sweden, and Bulgaria also have a substantial share, with 10% of their public charging points being ultra-fast chargers.

In the first quarter of 2023, the Alternative Fuels Infrastructure Regulation (AFIR) underwent revision, establishing guidelines for the extent of electric vehicle (EV) charging availability throughout Europe. This regulatory update demonstrates a clear commitment to advancing public charging infrastructure development across the continent.

As an illustration, by 2025, the European Union's Member States are required to ensure the presence of a fast-charging station within a maximum distance of 60 kilometers in each direction along the main European routes. This directive emphasizes the importance of enhancing the accessibility of fast-charging facilities for EVs across key travel routes.

For a comprehensive analysis of the latest situation of European EV charging expansion, please refer to the detailed insights in this article: Navigating Europe's EV Charging Expansion

Which Countries in Europe Have the Biggest EV Charging Network?

The Netherlands, Germany, and France are the top three countries with the highest penetration of public chargers (both slow and fast chargers combined) with the Netherlands at 144,453 charger points, Germany at 120,625, and France at 119,255 as of the end of 2003. In fact, the three countries account for more than 60% of all public charging points available in the EU. United Kingdom is in fourth place with 72,923 units, followed by Belgium with 44,363 public charging points for the same year.

The rate of installations in the EU experienced a slight deceleration in 2023 compared to the previous year, with growth figures declining from 49% in 2022 to 41% in 2023. Despite this general slowdown, several countries have made significant investments in expanding their electric vehicle (EV) charging infrastructure. Belgium, for instance, saw an impressive increase of 175% in their direct current (DC) charging points. Finland's charging network expanded by 103%, with alternating current (AC) charging points growing by 88% and DC charging points by 171%. Denmark reported a 112% overall growth in their charging network, with AC and DC charging points increasing by 110% and 136%, respectively. Similarly, Sweden observed a 52% growth in its charging infrastructure, with a 48% increase in AC charging points and a 93% rise in DC charging points.

Sources: Statzon, ACEA, PwC, EAFO, arenaev.com, Reuters, eu-evs.com, CleanTechnica, electromaps.com