Autonomous vehicles have become one of the hottest topics in the automotive industry. Also known as self-driving cars, these vehicles are considered a breakthrough innovation with a potential market. Although it’s an emerging market, and a vision of a fully self-driving car without human intervention will not be fully realized in the next few years, the market is already growing and thriving.

Global Self-Driving Car Market Size

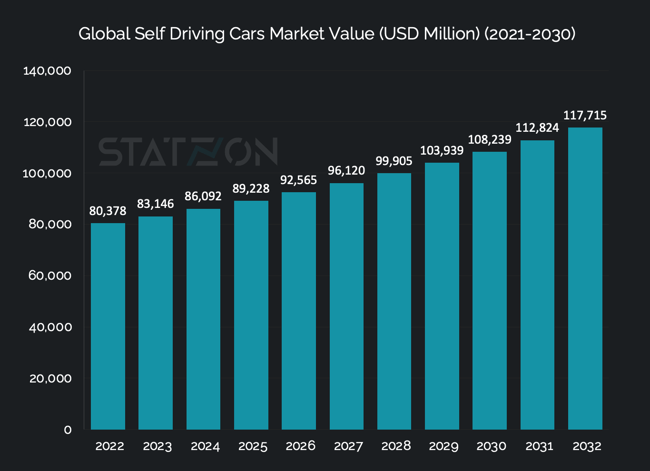

The global autonomous vehicle market's value in 2022 was worth USD 80.3 billion and by 2032 will reach USD 117.7 billion at a 3.9% CAGR, according to market research conducted by Apollo Research Reports. The market's acceleration has been slower than anticipated, leading to investor frustration over the gradual progress in the development of driverless cars, despite previous ambitious goals and confident forecasts. This shift in investor sentiment has placed considerable strain on an industry previously supported by generous funding and flexibility. Responding to economic pressures and a shifting landscape, many automakers have scaled back their development plans for this technology.

Robot taxi services are already available in select markets, but widespread implementation of autonomous technology will not be realized anytime soon. Fully self-driving cars are expected to remain limited in certain geographical and climate areas for at least the next decade. In the next decade, as reported by S&P Global Mobility, autonomous technology is likely to be focused mainly on two areas: robot taxis operating within set boundaries and partially autonomous systems in personal vehicles, which will include safety features and still require some driver involvement.

Source: Statzon/ Apollo Research Reports

Source: Statzon/ Apollo Research Reports

Autonomous Vehicle Market by Autonomy Level

The autonomous vehicle market is segmented into semi-autonomous and fully autonomous categories. Semi-autonomous vehicles, including Levels 1 to 3, rely on shared responsibility between the driver and vehicle technology for driving and safety. Fully autonomous vehicles, classified as Levels 4 and 5, can operate without human intervention.

The current autonomous vehicle market is evolving around semi-autonomous driving. Definitely less emphasis is given to fully autonomous technological advancement.

Level 2 autonomy, featuring in systems like Tesla's Autopilot and General Motors’ Ultra Cruise, is now a standard or optional feature in higher-end cars. These systems are advancing, gradually moving beyond Level 2. The transition from Level 2 to Level 3 represents a significant functional leap. Mercedes’ Drive Pilot exemplifies this advancement, certified as the first Level 3 conditional automated driving system in the U.S. It allows limited eyes-off driving, requiring drivers to be ready to resume control quickly, and will be available in Mercedes S-Class and EQS sedans from the 2024 model year.

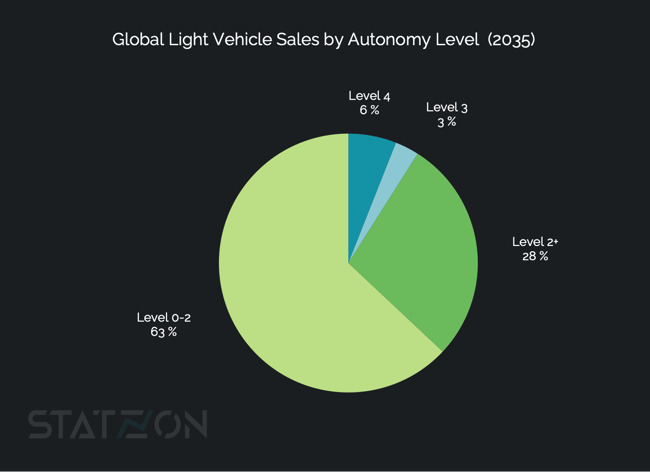

Drive Pilot stands out for its ability to operate in high-density traffic at speeds up to 40 mph, interpreting traffic signs and performing emergency maneuvers. This contrasts with many Level 2 systems that are limited to freeway driving. The deployment of Level 2+ and Level 3 systems is expanding, with forecasts suggesting they will constitute at least 31% of new vehicle sales globally by 2035. These systems enable hands-off driving while requiring driver supervision, or complete disengagement in specific scenarios.

Level 5 autonomy, capable of matching human driving in any scenario, is not expected to be available before 2035. Research done by S&P Global Mobility indicates that while Level 5 remains distant, the implementation of technologies in Levels 2+, 3, and some Level 4 applications is progressing more rapidly and will likely be realized sooner. This indicates a market trend towards more targeted uses of autonomous technologies in the near term, with full autonomy remaining a longer-term goal.

Source: S&P Global

Source: S&P Global

Autonomous Vehicle Market by System

Adaptive Cruise Control (ACC) and Adaptive Front Light (AFL) systems are integral components of self-driving cars, enhancing safety and driving efficiency. ACC allows vehicles to automatically adjust speed to maintain a safe distance from other vehicles, while AFL improves visibility during night driving by adjusting the headlights based on the vehicle's speed and steering. These systems are pivotal in the advancement and functionality of autonomous vehicles.

In 2022, the market value for ACC in autonomous vehicles was approximately USD 39.26 billion, a figure that is projected to grow to about USD 57.46 billion by 2032. This growth trajectory indicates a CAGR of approximately 3.9%, reflecting the increasing adoption and technological advancements in ACC systems within the autonomous vehicle industry. critical role in the operation and appeal of self-driving cars, encompassing advanced technology and being a key factor for consumers seeking comprehensive autonomous driving features.

Similarly, the AFL system, crucial for enhanced visibility and safety in self-driving cars, had a market value of around USD 19.41 billion in 2022. By 2032, it is forecasted to grow to approximately USD 28.49 billion, also with a CAGR of about 3.9%.

Additionally, the "other" systems segment in the autonomous vehicle market constituted approximately 22.7% of the total market value in 2022.

Autonomous Vehicle Market Share by Type of Mobility

Shared mobility is increasingly becoming the focal point in the autonomous vehicle (AV) industry, profoundly shaping AV system development. At the forefront of this transformation are robo-taxis, with companies like Cruise and Waymo leading the charge. These services, operating within precisely defined geofenced areas, are representative of the growing shift towards Mobility as a Service (MaaS). Waymo, having launched commercial services in Arizona suburbs, is now extending its testing to major cities in California. Similarly, Cruise is making strides with its public robo-taxi services in San Francisco and beyond.

The substantial costs associated with AV technologies, including cameras, radar, and lidar sensors, render them less practical for personal vehicles. However, they are proving invaluable for taxi and ride-sharing services that aim for round-the-clock operation. In 2022, the shared mobility sector eclipsed personal mobility in the AV market, securing a commanding 74% share. This dominance is anticipated to persist, with shared mobility expected to hold 65% of the market by 2030, continuing to overshadow personal mobility.

US and China Racing to Top Position

The US is the second-largest automotive market in the world and is currently at the forefront of the race toward fully automated vehicles. The country's self-driving vehicle market was valued at USD 17.2 billion in 2022 and is projected to reach USD 26.6 billion by 2032. The US has been a long-time leader in autonomous driving technology, steered by tech hubs on the west coast with companies like Uber and Tesla making headlines for both successes and failures. However, in 2022, China, with a market value of USD 7.8 billion, less than half of the US market, is rapidly advancing in the field of Advanced Driver-Assistance Systems (ADAS). The country is actively developing standards for assisted and autonomous driving and aims to become a leader in intelligent connected vehicles by 2025, a sector still in its early stages.

In the first half of this year, new passenger cars featuring autonomous driving functions made up 42.4% of the nation's total passenger car sales, showing a notable year-on-year increase of 10%.

China already overtook the US as the world’s largest automobile market in 2009. The country certainly enjoys favorable regulations and policies allowing the testing of self-driving cars in many cities. The US, on the contrary, has states' state-specific regulations without any nationwide authorization for testing. When a self-driving test vehicle crosses from California into Nevada, for example, it must stop first to change plates so it can continue the test in the new state. The regulatory roadmap that will allow. self-driving cars to be deployed on a mass scale is still far from ready.

But China also has its own problem. Production of autonomous vehicles in China is highly dependent on chips designed by foreign companies, mostly US groups Nvidia, Qualcomm, and Intel. Chinese chip industry is on the rise led by companies like MetaX Integrated Circuits and Biren Technologies trying to compete with western production. Yet they are still years behind their US rivals.

Consumer Attitudes Toward Autonomous Driving

Are we ready for autonomous driving?

Although there remains a strong interest in autonomous driving, c Consumer attitudes toward autonomous driving have shown a cautious shift, with McKinsey's 2021 Autonomous Driving, Connectivity, Electrification, and Shared Mobility (ACES) survey revealing a decline in the willingness to consider adoption of self-driving cars. The survey showed that readiness to switch to a private AV dropped nearly ten percentage points, with only 26 percent of respondents in 2021 expressing a preference for fully autonomous cars, compared to 35 percent in 2020.

This trend is further corroborated by the J.D. Power 2023 US Mobility Confidence Index (MCI) Study, which indicates a continuous decrease in autonomous vehicle acceptance for the second consecutive year. The MCI index score for consumer AV readiness fell to 37 (out of 100), which was 5 points lower than the score in 2021. This decrease in confidence is attributed to limited public knowledge about AV technology and negative media coverage focusing on robotaxi and testing failures.

However, the J.D. Power study also highlights the impact of firsthand experience on consumer perceptions. Consumers who have ridden in a robotaxi in cities like Phoenix or San Francisco showed a significantly higher MCI index score of 67, almost double that of those who haven't had such experiences. This suggests that direct interaction with AV technology can greatly enhance consumer comfort and trust.

The study also notes that consumer comfort with AVs is higher in regions like the West of the U.S., where there is more familiarity with AV testing and deployments. Despite these regional variations, there is a general trend towards increased skepticism and a need for more education and positive exposure to improve consumer acceptance of autonomous vehicles.

JD Power also noticed misconceptions about autonomous vehicle capabilities. While many can accurately identify available AV delivery services and robotaxis, there's a misunderstanding about the automation level of personal vehicles, with 22% incorrectly identifying Tesla’s “Autopilot” as fully automated.

In terms of market readiness, the McKinsey ACES survey reveals diverse consumer attitudes towards autonomous driving (AD) features pricing, depending on their driving habits and needs. Frequent drivers, for example, tend to see more value in AD features, while parents primarily using cars for short trips may be less enthusiastic. This variation in consumer preferences suggests the importance of offering different pricing options in the market.

To cater to these varied needs, OEMs and dealerships could consider implementing flexible pricing models. These could include a fixed one-time fee for certain AD features, subscription-based services for ongoing use, and even pay-per-use options, such as an hourly rate for specific functionalities like a traffic jam pilot. The survey indicates that consumer preferences are split: 20% of interested respondents favor a subscription model for ADAS features, nearly 30% prefer a pay-per-use approach, and about 25% are interested in the ability to upgrade their vehicle with additional ADAS features after purchase.

Sources: Statzon, The Verge, MIT, WE Forum, McKinsey (1), McKinsey (2), McKinsey (3), Financial Times (1), Financial Times (2), programbusiness.com, S&P Global, usnews.com, China Daily, JD Power, wardsauto.com